Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

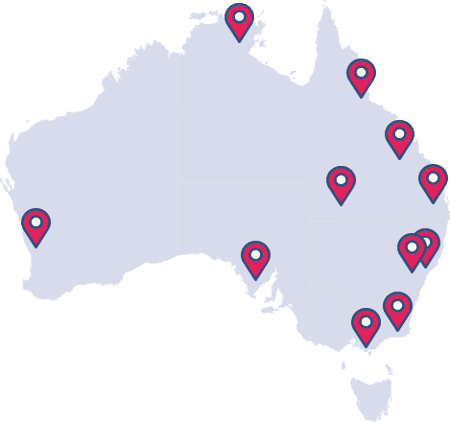

National Network

Officers across Australia

Why Australian Debt Solvers?

The Australian Debt Solvers team consists of experts across all relevant fields including insolvency, finance, accounting, business strategy, operations and technology.

This means that we are able to provide expert advice regardless of the business life cycle stage that you are in. Whether you are starting a new venture, in the process of a merger and acquisition, or looking to explore areas of growth, contact us for a free consultation.

Rated 5 Out of 5

What is Business Advisory?

Business advisory is the process of analysing all aspects of an organisation to identify problems, recognise potential risks and capitalise on opportunities.

A detailed assessment of your current position is essential and involves more than just looking at financial records. Business advisory includes strategy, marketing, human resource, technology and operations.

Extensive knowledge across all areas combined with business acumen allows us to provide effective business advice.

Our Business Advisory Services

Our team has the experience and insights to provide professional advice that will have a positive impact on your business.

Business Design & Improvement

Expert advice on key areas including: strategy, analytics & modelling, cash & working capital, revenue growth and operational improvement.

Transactions

Whether you are acquiring or selling a business, we can provide sale assistance, accurate valuations and help ensure due diligence is completed.

Financing

Our business advisory services include all areas of financing including debt, equity and internal. Find out which is best for you.

Our Business Advisory Process

Our experience in recognising and assisting struggling companies ensures that the best possible outcome is achieved for all parties involved. Here is a brief look at our business advisory process.

5 Steps

Examine

Whether an organisation is facing financial distress or seeking growth opportunities, the first step of our business advisory experts is to conduct a thorough examination of the business.

This will involve evaluating financial and operational aspects in order to properly assess the current state of the business. Our advisory team includes professionals across all key business areas including finance, accounting, risk management, operations and technology. As a result, an accurate assessment can be made both effectively and efficiently.

Free Business Health Check

It's never too late! As business advisory experts, we have found that being proactive can be the difference between success and failure.

Whether you are looking to get back on your feet or simply want to have some professional advice regarding your business, our free business health check is a very useful tool.

It includes a detailed report on key areas of your business and is accompanied by a free 1 hour consultation with one of our experts.

Expert Business Advisory Advice

Our results driven business advisory team specialise in helping directors and companies achieve financial prosperity. At Australian Debt Solvers it is not enough for us to see a business achieve its goals, our aim is to surpass set targets and create new goals.

Employing our business advisory services means allowing a team of experts to provide professional advice that will ensure a successful future.

Find an Office

For business advisory services in Australia look no further that Australian Debt Solvers. With offices throughout the country and the support of a professional online team, access is fast and easy. Our specialists are available over the phone or in person at one of our many office locations.

Business Advisory Resource Centre

Want to learn more about business advisory and how expert advice can help your business? Check out the Australian Debt Solvers Resource Centre featuring detailed information from industry professionals.

Latest News

Stay up to date with the latest business advisory news. From case studies to changes in legislation, one piece of information could put your business on the right path.

Business Advisory FAQs

Read about our most common Business Advisory questions and answers.

The most effective way to check the financial health of a business is to seek the services of financial experts such as Australian Debt Solvers. A team of experts will assess all aspects of your business, provide a detailed report and a list of recommendations which should be implemented.

For a preliminary assessment feel free to conduct a Free Business Health Check. Simply sign up and log in to our easy-to-use platform. You will be asked a series of questions relating to your business and provided an overall health score, as well as individual departmental scores and advice.

The most appropriate wat to manage business finances is by employing an expert which in this case is an accountant. Below is a list of the reasons Why Your Business Needs An Accountant:

- Optimal structure

- Minimise you tax bill

- Best accounting software

- Smarter cash flow management

- Budgeting and spending

- Review, forecast and plan

- Revenue Growth

- Set goals and benchmarks

Keeping track of your business finances is critical as it enables you to know exactly what is going on with your sales and expenses which consequently allows you to make smarter business decisions. Staying on top of your finances makes tax reporting easy, could help you avoid disaster, and will make your business more profitable.

Check out our top tips on how to stay on top of your business finances.

Whether you have an accountant or not, all small business owners need to have a system in place that helps them track their income and expenses. Some simple steps include:

- Create digital receipts

- Have a dedicated business bank account

- Use accounting software and sync it with your bank account

We urge people to take advantage of technological advancements with a large range of invoicing apps out there to help people with small businesses.

Business advisory can be used to identify problems, recognise potential risks, capitalise on opportunities, and to avoid potential insolvent trading.

The process is similar irrespective of the aim and includes first conducting a detailed assessment of a business. It will look at the prime areas of business including finance, sales, marketing, and organisational structure.

Our team of experts can properly analyse your business, provide suitable recommendations, and work alongside you throughout the implementation process. Let your goal become our goals. Contact Us today for a free consultation.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5