Registered by ASIC

Liquidators

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

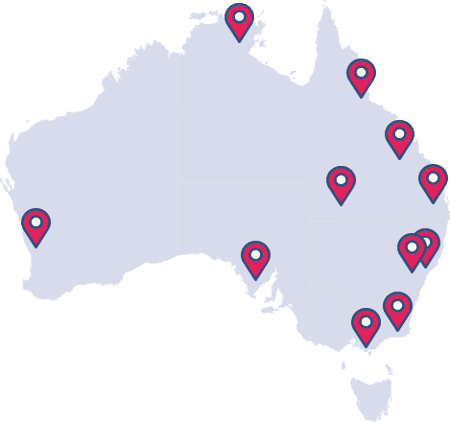

National Network

Officers across Australia

Why Australian Debt Solvers?

At Australian Debt Solvers, we deal with receivership Australia wide. If you are a creditor that is owed money or concerned about a secured asset, take the time to talk to someone from our team.

A free consultation is the first step to protecting your interests. There are a number of reasons why businesses get themselves into financial difficulty. Our expects will take the necessary steps to ensure that the failure of others does not lead to a failure of your own.

Rated 5 Out of 5

What is Receivership?

A company enters into receivership for the purpose of repaying debts to a secured creditor. A receiver and manager may be appointed by a creditor or court. If you have any concerns regarding your assets, the first step is to seek professional advice.

Taking proactive measures and exploring company receivership can be extremely beneficial. Not only can it protect your interests, it will also provide the company in question with the best prospects of both repaying its debts.

Our Receivership Services

Whether you are a financial institution, company or sole trader, we can help. Receivership services for secured creditors.

Lenders

Financial institutions or individuals that have made loans to a company can recover money owed through the process of receivership.

Suppliers

Poor management and financial decisions can result in companies failing to pay suppliers. Don't let debt build to an insurmountable amount.

Consumers

Have you paid for goods or services that have not been received? Don't wait. Speak to one of our experts today.

Employees

Receivership is also an option for employees who are owed money for unpaid wages and other entitlements.

Our Receivership Process

Our experience in managing struggling companies ensures that the best possible outcome is achieved for all parties involved. We make the process of receivership seamless and stress-free.

5 Steps

Appointment Documents

The process of receiverships involves the payment of money to creditors for money that they are owed. Creditors can be secured or unsecured and may be owed money for a variety of reasons including:

- Goods or services that have been supplied or provided

- Loans that have been made to a company

- Paid for good or services that have never been provided

- Existing or former employee that has not been paid wages and/or other entitlements such as superannuation

In any of these circumstances, a receiver may be appointed to take control for the purpose of repaying debts.

Why Australian Debt Solvers?

Our experience and relationship in the field of receivership make a complex process simple and hassle-free. A receiver and manager will recover or protect your interests while ensuring that the company in question is provided with the best prospects of trading in the future.

We provide affordable receivership services and minimise complications associated when attempting to recover debt or secure assets.

Meet Our Receivership Professionals

There is no shortage of experience at Australian Debt Solvers. We have a long history in the field of corporate insolvency and dedicated teams when it comes to receivership.

Employing our receivership services means allowing a team of experts to take control of what can be a complicated process. Protecting the interests of creditors is our paramount concern. A receiver will take control and protect your interests by collecting and selling some or al of a company's assets.

Find an Office

We know the importance of access which is why we provide receivership services Australia wide. You can speak to one of our specialists over the phone or arrange a face to face consultation at one of our offices. Search for the office closest to you and take the first step in protecting your interests.

Receivership Resource Centre

Want to learn more about receivership or how to appoint a receiver and manager? Check out the Australian Debt Solvers Resource Centre featuring detailed information from industry professionals.

Receivership Latest News

Want to learn more about the receivership process and legal requirements? Expand your knowledge and understanding by taking a closer look at real-life case studies.

Receivership FAQs

Read about our most common Corporate Insolvency questions and answers.

The role of a receiver revolves around three key areas

- Protect, collect, and sell: This process may involve selling some or all the company's assets to repay debts.

- Distribute: Payout any proceeds in the correct order as set out by legislation.

- Report: The receiver must provide ASIC with a detailed list of receipts and payments. They are to also inform the regulator of any possible offenses.

If your bank is planning to appoint a receiver it is likely that you have been unable to pay your debts on time. In this circumstance, the creditor is the bank that holds an interest in one of your non-circulating assets. This may include property, land, plant, or equipment.

The role of the receiver is to act on the behalf of the creditor (bank). It is important to protect your own interests and the best way to do so is by obtaining professional advice and representation.

Read more about Australian Debt Solvers receiverships services and how we can help.

A secured creditor is an entity that holds a secured interest in some or all company’s assets. This is usually in the form of a mortgage. Companies regularly obtain finance in the form of a loan and in the process provide company assets as a form of ‘security’. In this case, the financial institution that provided the loan is a secured creditor.

There are several key differences between the three and they are made clear in the roles carried out by each party.

- A receiver is appointed by a secured creditor that holds an interest in some or all the company’s assets. Their role is to collect and sell assets to repay debts owed to the secured creditor.

- The role of an administrator is to examine the company and report to its creditors. The report will outline information on company assets, management of affairs, processes, and current financial circumstances. Recommendations will also be provided.

- In comparison, a liquidator has a responsibility to all company creditors. Their task is to protect, collect, and sell all company assets. The proceeds are then distributed to creditors with an inquiry into the failure of the company also conducted.

Read more about the difference between receivership, administration, and liquidation.

In most circumstances receivership is not a choice made by directors but rather appointed by a secured creditor such as a bank. The options of directors are limited during this process which is why it is important to be proactive if your company is experiencing financial stress.

Acting early provides directors with a number of options including voluntary administration, restructure and turnaround, and safe harbour to name a few.

In many circumstances, directors may be able to maintain control while attempting to return the company to a position of financial strength.

If you are concerned about your business, Contact Us today for a free consultation.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5