Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

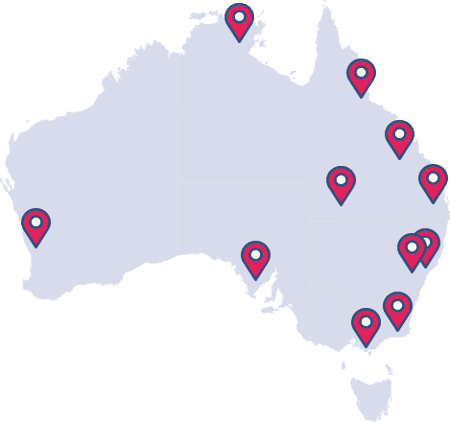

National Network

Officers across Australia

Safe Harbour Support You Can Trust

As defined by the Corporations Act 2001 (Cth), safe harbour is taking course of action reasonably likely to lead to a better outcome for the company. When a director has any reason to suspect their company is approaching insolvency, it is time to act.

It is essential to be proactive rather than reactive as this will provide your business with the best chance to realise its potential. Our team of professionals includes legal experts who have a comprehensive understanding of safe harbour provisions and the best way to take advantage of them.

Help in the form of a free consultation is just one phone call away.

Rated 5 Out of 5

What Is Safe Harbour?

Safe harbour applies when a director, after anticipating that a company is approaching insolvency, develops a plan or set of strategies that are likely to lead to a better outcome. The primary aim of accessing safe harbour laws is to avoid the immediate appointment of a liquidator or administrator.

The safe harbour provisions provide directors with protection from civil liability for insolvent trading. This effectively provides directors with the time required to develop and implement a restructure and turnaround.

Understanding Safe Harbour

As industry experts, we have found that directors are in many cases uncertain with respect to their options, rights and responsibilities. Speak to a team of professionals who can provide you with definitive advice and a course of action that will deliver the best possible outcome.

Safe Harbour

Our team of experts will determine if you are eligible to access safe harbour provisions. Those eligible will be afforded a reasonable time frame and remain in control of the process.

Our Safe Harbour Process

One of the benefits of safe harbour is that you remain in control of the process. If eligible to access safe harbour laws, directors should then consider taking the steps outlined below.

5 Steps

Check

When using safe harbour insolvency, a range of factors need to be considered. Below is a simple checklist that directors can use to determine if they are carrying out their duties and responsibilities.

- Have any outstanding employee entitlements have been paid?

- Is the company meetings all of its tax reporting obligations?

- Are employees complying with company policies and has any misconduct been handled accordingly?

- Are all insurance and indemnity policies adequate and paid?

Why Australian Debt Solvers?

Getting professional advice can be the difference between reviving a company or having it forced into liquidation. At Australian Debt Solvers our aim is to help companies realise their potential.

We do this by working with our clients in order to properly understand their situation and provide advice accordingly. Having an in-house team of professionals means that we can act both quickly and effectively.

Meet Our Safe Harbour Experts

As industry experts, we have found that directors are in many cases uncertain with respect to their options, rights and responsibilities. This is why it is important to speak to a team of professionals who can provide you with definitive advice and a course of action that will deliver the best possible outcome.

Our team consists of professionals across all critical areas including but not limited to: legal, accounting, leadership, consolidation, financial planning, business operations and change management. Contact Australian Debt Solvers today and get the right advice.

Find an Office

One of the unique benefits of dealing with Australian Debt Solvers is the presence of a personal service. Not only can you access our team of specialists over the phone, we can also meet you in person to discuss all maters including safe harbour. Find your local expert today!

Safe Harbour Resource Centre

Want to learn more about safe harbour provisions and how you may be able to access them? Stay up to date with safe harbour laws and any safe harbour reforms that could impact your business with the Australian Debt Solvers Resource Centre.

Safe Harbour Latest News

As a director, it is important to be well informed. Our news portal is a great way to be knowledgeable with respect to industry news and case studies. Learn about how others used safe harbour provisions and what it means to take a course of action that is 'reasonably likely' to lead to a better outcome.

Safe Harbour FAQs

Read about our most common Safe Harbour questions and answers.

Safe harbour provisions apply when a director identifies that a company is approaching insolvency and develops a plan that will likely lead to a better outcome. When accessed, the safe harbour provisions provide company directors with an exemption from being held liable for trading while insolvent.

Safe harbour legislation has been implemented for several reasons including:

- Allow directors relief from personal liability

- Provide the best prospects of a restructure and turnaround

- Help more companies fight their way back from insolvency

- Greater flexibility for companies and directors

- Shift director focus from self-preservation to progress and prosperity

A director is eligible to access safe harbour provisions if they can show that they were in the process of taking a course of action that was reasonably likely to have a better outcome than a voluntary administration or liquidation. Some of the factors considered for eligibility include:

- Maintained financial records

- Taken steps to prevent misconduct

- Obtained professional advice

- Developed and implemented a restructuring plan

- Lodgement of all relevant tax documentation

Despite the absence of a defined time period, the provisions do state that attempts to improve the company situation must be completed in a ‘reasonable time frame’.

The best practice is for any restructuring plan to have guidelines with respect to review and potential adjustment. Changes can be made if a restructuring plan remains the best option for the company.

In the event that this ceases to be the case, the company directors should seek professional advice.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5