Financial advisory solutions in Sydney for all aspects of voluntary administration.

Australian Debt Solvers offers professional advice and comprehensive financial services delivered with expertise. Get in touch today.

Get a Free ConsultationSydney Contact Details

Australian Debt Solvers works with clients across Sydney. Our head office is located in the Sydney CBD, with other offices located throughout Australia. You can contact us directly via our website, call us on 1300 789 499 for a free consultation, or visit us in person at Level 2, 10 Bridge Street, Sydney NSW 2000.

- Suite 12.02 Level 12, 20 Bridge Street, Sydney NSW 2000

- Call now: 02 8324 7463

Get Your Free Consultation on Voluntary Administration

Voluntary administration is an insolvency process that allows a struggling company to continue operations by being placed in the hands of an independent person. Unlike liquidation, which describes the end of operations, voluntary administration provides companies with an opportunity to start fresh, manage their financial obligations, and create new opportunities for the future.

At Australian Debt Solvers, we can help to assess your current financial situation, research your available options, and generate the best possible outcome for all stakeholders. From business owners and employees to partners and creditors, voluntary administration is a sensitive process likely to affect a number of invested parties. In the case of voluntary administration, expert consultation is the key to a successful outcome.

We offer a free consultation service to help you manage your debts, structure your administration, and define the best course of action for your future. We work with your team throughout the process and create effective solutions based on recognised Australian standards and law. Please contact our team for a free consultation today.

Send a Direct Message

Our Approach To Financial Success

At Australian Debt Solvers, we approach each financial scenario with respect and professionalism. Each client and situation is unique, and every challenge creates an opportunity for growth. We combine expert knowledge and industry experience with professional responsibility and attention to detail.

As the leading financial advisory service in Australia, our uncompromising and professional approach is reflected in numerous success stories. We have worked with thousands of clients in Sydney and helped countless people to move forward and overcome their financial challenges. If you need inspiration and practical advice during a tough time, please watch our video to see how we can help you.

Research About Voluntary Administration

Voluntary administration attempts to resolve outstanding financial, legal, and administration issues quickly in a way that respects all invested parties. If company directors or creditors suspect insolvency, an independent administrator should be appointed as quickly as possible. A voluntary administration can be triggered for many reasons: Company directors who suspect insolvency, Secured creditors with a security interest, Pressure from multiple creditors, Pressure from banks or lenders, Disputes between directors and shareholders, Significant legal action.

The success of this process is based on many things, including the extent of the financial problem, the speed of intervention, and the administration skills of the new team. In most cases, a voluntary administration lasts between 25 to 30 business days. This period is critical as it provides the time and resources needed to deal with internal problems and enter into new financial agreements with creditors. At the end of this period, the company either moves forward with a Deed of a Company Arrangement or is placed into liquidation.

Along with expert financial advice, we provide access to an extensive online knowledgebase about voluntary administration in Australia. If you would like to learn more about this process, please take a look at our Research Centre. The ADS Research Centre merges industry insights with expert guidance and practical tips to help you manage voluntary administration and move forward with confidence.

How to Save a Company: Appoint an Administrator, Not a Liquidator

One of the most common areas of misunderstanding is in the difference between liquidation and administration. These terms represent two very different things, but for a company that won’t be able to return from the brink due to financial stress, it will be important to consider which path to go down.

Read more

A Guide to Administration

When your business is struggling, it’s best to seek financial advice to understand the options available. One option is to go into administration to assess the company’s viability, and possibly turn its fortunes around.

Read more

Voluntary administration: Implications for Companies

For companies facing the prospect of insolvency, voluntary administration is like hitting the pause button for some breathing room. It lets you bring in external experts who can make recommendations as to the best future course of action for the company.

Read more

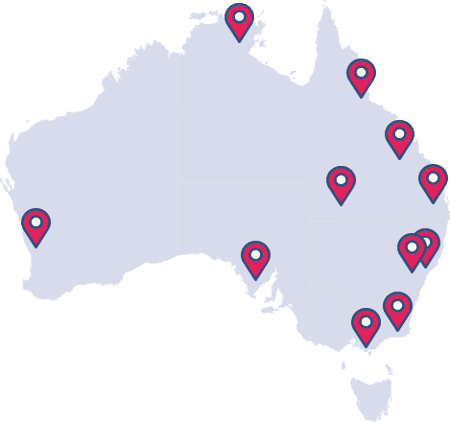

Find an Office

Australian Debt Solvers are experts in helping people through potential bankruptcy and insolvency across Australia. Find the closest office to you:

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5