Registered by ASIC

Liquidators

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

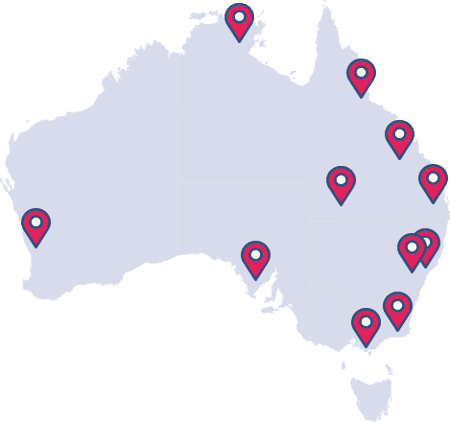

National Network

Officers across Australia

Voluntary Administration Services You Can Trust

At Australian Debt Solvers, our team consists of qualified insolvency practitioners and administrators who are professional ARITA members. Employing our services means dealing directly with our team and not any external third parties.

Our experts can accommodate restructure, turnaround, and safe harbour solutions. Through voluntary administration services and the use of a deed of company arrangement, we have saved businesses across Australia. Contact us today to avoid insolvent trading, personal liability, and potentially liquidation.

Rated 5 Out of 5

What Is Voluntary Administration?

Financial difficulties can be caused by a variety of reasons; bad debts, poor decisions, lower than expected sales, or external economic factors just to name a few. Dealt with accordingly, liquidation can be avoided and a bright future restored. Talk with one of our experts before you run out of time.

Company administration could be the solution that provides the breathing space required to reduce debt, restructure, and devise a plan for growth. Contrary to what you may have heard, the process of voluntary administration does not have to be a costly exercise.

Understanding Voluntary Administration

If you are looking to free your business from crippling debt it is time to get expert advice and clear guidance. A professional administrator will point you in the right direction.

Our Voluntary Administration Process

In order to provide a personalised service, our team will take the time required to understand your business. This allows our experts to ensure that your voluntary administration takes place in a seamless and transparent fashion.

6 Steps

Appointment Documents

Making the decision to appoint an administrator can be difficult, but it could be the difference between saving a company or being forced to liquidate. Our team will prepare the required documents and ensure they are distributed to the parties that are required to sign them.

Why Australian Debt Solvers?

Getting professional advice can be the difference between reviving a company or having it forced into liquidation. Australian Debt Solvers will address your financial issues and act quickly to ensure the best possible outcome.

Learn More

Meet Our Voluntary Administrators

With administrators as part of our specialist team, we alleviate the stress that voluntary administration can cause. We have the necessary experience to quickly recognise what is causing financial hardship and the expertise to determine possible solutions. Take the right step for your company and speak to one of our administrators.

Meet the teamEnquire now

Find an Office

Business has no boundaries and neither do we. No matter where you are in Australia we are here to help. Australian Debt Solvers have offices located across Australia with team members ready to assist. Our team are ready to take your call and arrange an appointment for you to meet one of our specialists in person. Find your local expert today!

Voluntary Administration Resource Centre

Want to learn more about Voluntary Administration? Check out the Australian Debt Solvers Resource Centre which features in-depth articles written by industry professionals. Updated regularly, you can learn about the process of administration and what it means for the parties involved.

Voluntary Administration Latest News

Voluntary Administration is a challenging time for any company and all of the parties involved. Stay up to date with the latest news from some of the foremost expert liquidators Australia has to offer. Read case studies and expand your knowledge. It may help you make the right decision.

Voluntary Administration FAQs

Read about our most common Voluntary Administration questions and answers.

ATO debt is split into four main areas: GST, income tax, PAYG, and superannuation. Company directors can be personally liable for PAYG and superannuation. If you have not lodged your Business Activity Statement (BAS), and your superannuation returns on time then you may be personally liable. The same applies to penalties or notices that have not been addressed.

In any of these circumstances, contact Australian Debt Solvers for a free consultation and professional advice.

Learn more here

The difference between administration and liquidation revolves around the state of the company. The process of administration aims to help a company repay debts to avoid insolvency if it is a viable option. In comparison, liquidation is the process of selling all the company assets, repaying debts, and dissolving the company completely.

Read more about the difference between receivership, administration, and liquidation.

A company goes into administration after an administrator is successfully appointed. The administrator will assume the responsibilities of the directors and carry out their roles and responsibilities with the aim of paying off company debts.

If successful, the company will then be handed back to the directors. If unable to do so, the company will go into liquidation.

When a company is in financial distress, the common desire is to avoid liquidation and pave a path towards financial prosperity. Voluntary administration is often the most suitable solution due to the benefits it provides. They include:

- Inexpensive

- Provides breathing space required to properly assess the business and determine the most suitable outcome.

- Help directors avoid insolvent trading as it temporarily prevents creditors from enforcing their claims.

- Increase prospects of returning to profitability as an external administrator can look at the state of the business from an objective perspective and use their experience to provide expert recommendations.

Read our comprehensive Guide to Voluntary Administration for additional information.

If a director decides to place a company into voluntary administration their responsibilities do not come to an end. They must:

- Relinquish control to the administrator.

- Assist the administrator. This may include providing financial records, information about the business including processes and key personnel.

- Prepare for possible outcomes by attending creditor's meetings and holding regular discussions with administrator.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5