Registered by AFSA

Trustee

CPA and CA

Qualified Accountants

Dedicated Team

Enquiry service 24/7

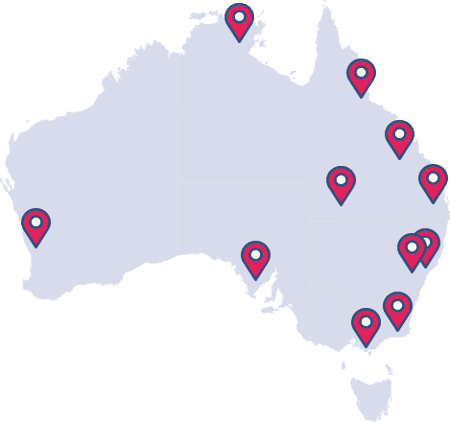

National Network

Officers across Australia

Our experts have helped Australians just like you for over <b>20</b> years. Let us help you live debt free. Get in contact today

Our experts have helped Australians just like you for over 20 years.

Let us help you live debt free. Get in contact today

What are my options?

We’re here to relieve the financial distress you are experiencing and provide a tailored pathway to financial stability.

Bankruptcy

Bankruptcy sounds daunting, but it doesn’t need to be. Contrary to what many people believe, bankruptcy does not mean you ‘lose everything’. Our in house registered Trustee guides you through the process, step by step, in an efficient manner to relieve any of your stress. If you no longer have control of your finances, there are two types of bankruptcy you can enter; with assets or without assets.

How it works:

- Bankruptcy is typically a 3-year process, which we guide you through the entire time.

- We will submit a declaration to Australian Financial Security Authority (AFSA) as to your financial position

- Following the decision, our Trustee helps take control of your financial situation and sell your available assets

- You may also be required to make contributions to your estate should your income be in excess of the limits

- Following the collection of all available funds a distribution is made to your creditors as full and final satisfaction of your debts and you can be discharged from bankruptcy, debt free.

Debt Agreement

A debt agreement is a legally binding agreement between you and your creditors to repay your debts over a period of time, up to a maximum of 3 to 5 years. To enter a debt agreement, you must meet the below requirements:

- Your total debts cannot exceed $123,578

- You must have less than $247,156 in divisible property

- Your annual income after tax must not exceed $92,683.50

Secured creditors, such as mortgages holders or finance agreements cannot be included in your debt agreement and will need to be continued to be paid throughout the period.

How they work:

- We will propose to pay a percentage of your total debt over a period of time and lodge your proposal with Australian Financial Security Authority (AfSA) . Following

Afsa Approval, your creditors are given time to vote on your proposal. - We assess what is affordable to you, and propose repayments to your debt agreement administrator, who holds the funds over the course of the agreement.

- Following the final payment, the agreement ends, your creditors will be paid the agreed amount and your creditors can no longer recover the rest of the money you owe.

Informal Debt Agreement

An informal debt agreement is a personalised payment plan between you and your creditors to help manage and repay your debts.

There are many benefits to an an informal debt agreeement, it is not a legally binding agreement and you won’t be listed on the National Personal Insolvency Register. Entering an informal debt agreement means that the interest is frozen and your debt will be paid off between 3-5 years. There are no restrictions on your income, travel, homeowner status or being a director of a company.

How does it work?

We can guide you through entering an informal debt agreement in four simple steps.

- Get in contact with our team of insolvency experts for your free consultation. During this time we will evaluate your situation, ensure an informal agreement is the best option for you and review the proposal to be able to act on your behalf.

- Next, we will assess your financial situation and together we will verify what is affordable to you.

- We will contact and negotiate with your creditors directly. During this time, we place your accounts on hold for 6 months before putting forward the an informal debt agreeement proposal.

- The final step involves our team negotiating the agreement to ensure the repayments suit you and your financial situation.

Personal Insolvency Agreement (PIA)

A personal insolvency agreement (PIA), is a proposal by you to your creditors, to alleviate your financial distress. We help arrange this through our in-house registered Trustee as this is a legally binding document. A PIA states how you will pay your debts and the length of the agreement can depend on what is affordable to you. In this case, our Trustee helps you take control of your property and sources solutions to pay part or all of you debts back through instalments or a large sump, again, depending on what is affordable to you.

How it is used:

- There is no minimum debt limit for a PIA

- Once appointed, our Trustee takes management of your assets and financial affairs. We provide a proposal to your creditors to settle your debts

- At a meeting of your creditors, it is decided whether the proposal is deemed acceptable

- You won’t be asked to forfeit your property

Personal Insolvency Experts

The thought of personal bankruptcy can be daunting. One of the biggest issues is a lack of knowledge and a limited understanding of the process. At Australian Debt Solvers, we have in-house AFSA Registered Trustees who lead a team of professionals that can provide you with expert bankruptcy advice.

Our specialists have the experience required to provide care and empathy in a time of need. We will guide you every step of the way, and complete the process quickly in order to relieve any stress.

Rated 5 Out of 5

Providing Personal Insolvency

At Australian Debt Solvers, our aim is to reduce financial distress by providing

personal insolvency solutions. We are well aware that no two scenarios are the same which is why it is necessary to get expert advice.

Knowledge and experience have allowed our team of professionals to form a process that ensures a better future for our clients. We can assist with your financial challenges and make your financial position more manageable.

Meet our Personal Insolvency Experts

At Australian Debt Solvers, we are in the business of helping people who are in financial distress. We do what we do to help people through the situation they are in, to a better outcome – whether they are a Director of a multi-million dollar company or struggling to make ends meet with their personal finances.

Meet the teamEnquire now

Personal Bankruptcy Australia Wide

Australian Debt Solvers is a national firm with the ability to provide a personal service. Our team specialise in helping people through potential bankruptcy and insolvency. Contact your closest office to arrange a free consultation.

Personal Insolvency Resource Centre

Want to learn more about Personal Insolvency? Read the Australian Debt Solvers Resource Centre which features in-depth articles written by industry professionals.

Personal Insolvency FAQs

Some of the most commonly asked questions when it comes to Personal Insolvency

There are many benefits when entering into a Personal Insolvency Agreement (PIA). Entering a Personal Insolvency Agreement (PIA) allows you to avoid bankruptcy, releases you from your unsecured debts and has a reduced timeline of 3-6 months.

Many people opt for an informal debt agreement to resolve their financial distress as it does not have any impact on your credit score. An informal debt agreement gives you the opportunity to negotiate a reduced repayment plan.

Given your situation improves, you can contact your insolvency practitioner who arranged your debt agreement. They will act on your behalf to re-negotiate the debt agreement, in order for you to repay the debt earlier than stated in the agreement.

Filing for bankruptcy would be your best option if you:

- Are unable to pay your debts when they are due or,

- Have exhausted all other debt relief options

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5