Personal Insolvencies Decrease FY21

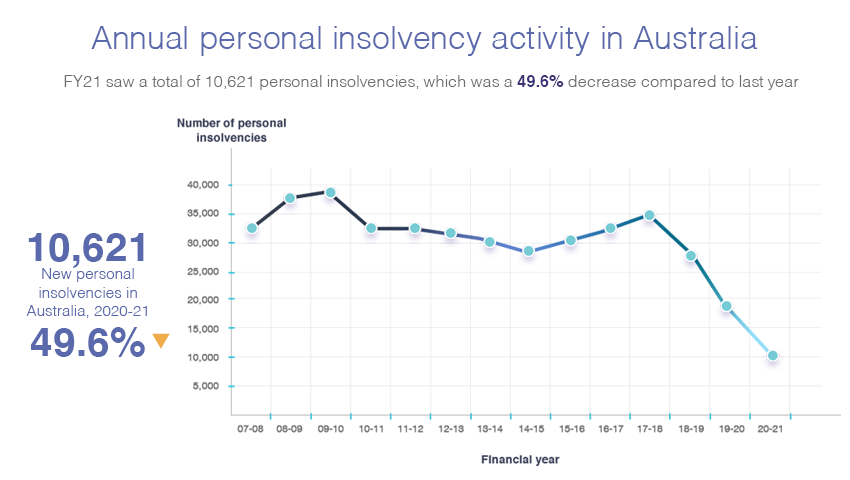

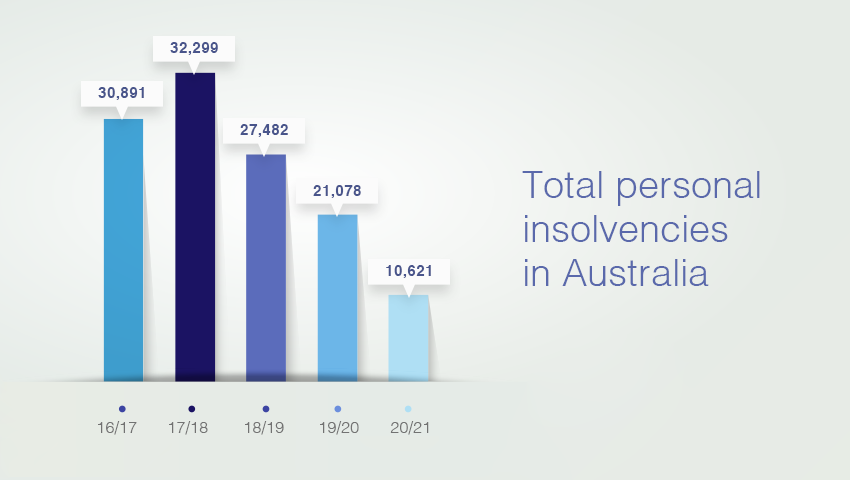

Personal Insolvencies are down by almost half in the last FY21. In the midst of the pandemic that saw the closure of many businesses, the affect upon personal insolvencies interestingly took an immense decrease compared to the previous year. The team at Australian Debt Solvers put the overall decline of 49.6 per cent as a result to government stimulus packages.

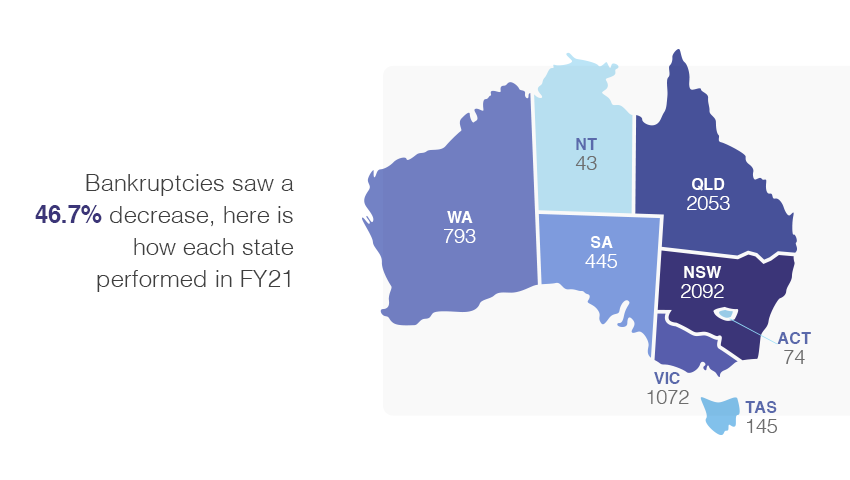

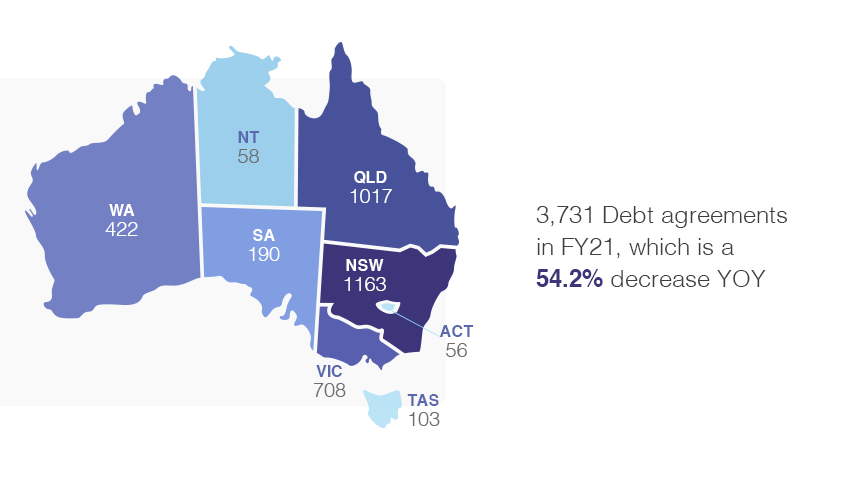

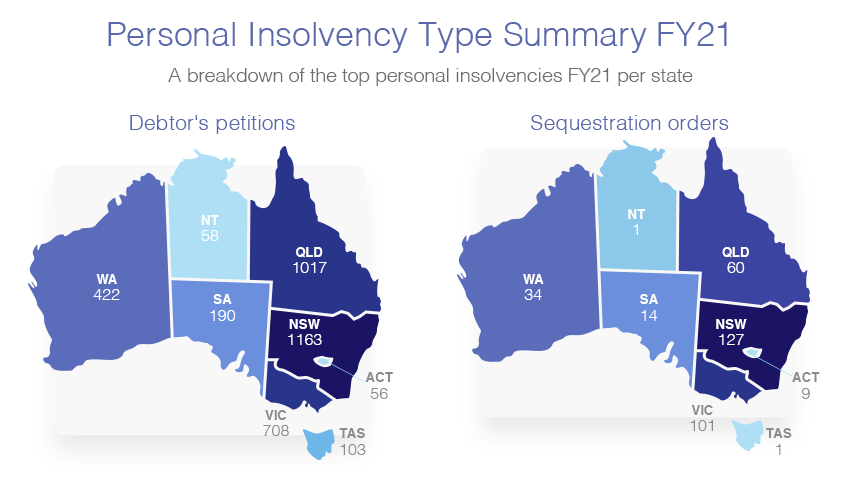

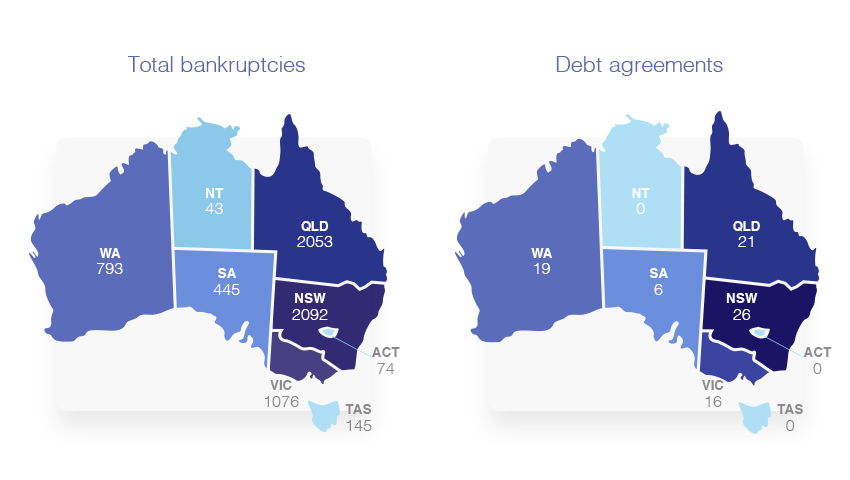

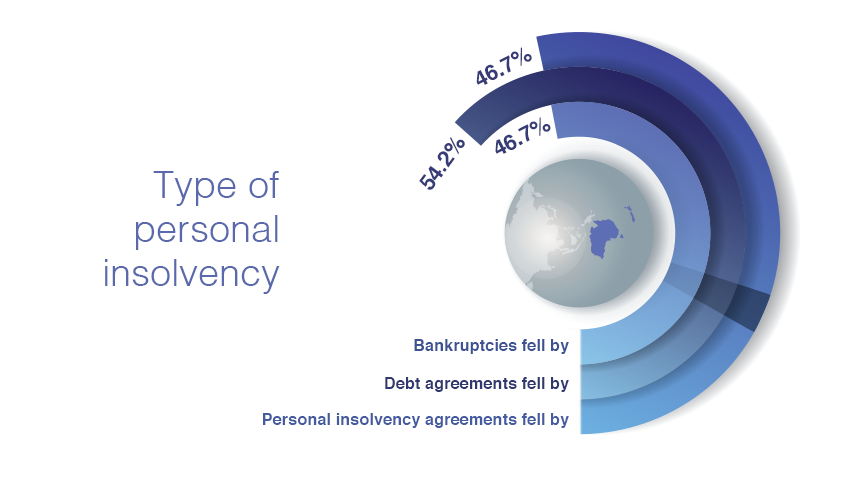

Surprisingly, insolvency wasn’t impacted as much as you would expect during the pandemic, as the data suggests. Personal bankruptcies saw a national decrease by 46,7 per cent and personal debt agreements also decreased by 54.2 per cent. This meant that people were still able to meet their financial obligations and didn’t need to enter a debt agreement to create an arrangement to repay creditors. There was a total of 10,621 personal insolvencies nationally in FY21 compared to the previous financial year of 21,078.

Please find our personal insolvency infographic here.

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5