Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

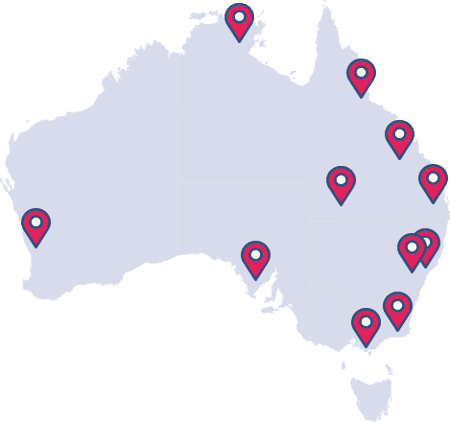

National Network

Officers across Australia

Why Australian Debt Solvers?

Australian Debt Solvers are industry leaders in financial advisory. Our team of insolvency experts includes in-house liquidators that are all ARITA professional members and registered by ASIC. Combined with a dedicated enquiry team that provides a 24/7 service, there isn't a financial problem that we are not able to assist you with.

Our insolvency services include company liquidation, voluntary administration, restructure, and turnaround along with bankruptcy and receivership. Whether the turnover is $100K or $100 million, we can make the hard answers easy to find.

Rated 5 Out of 5

What Is Corporate Insolvency?

Corporate insolvency is when a company or person is unable to pay any outstanding debts on their due date. It is illegal to trade insolvent and this is where Australian Debt Solvers can help. We specialise in advising directors on the best course of action to address the financial hardship that they are facing.

The most common procedures for an insolvent company are liquidation, receivership, and voluntary administration. If the issues are addressed in a timely manner, restructure and turnaround usually becomes a more viable option. Contact our team for expert advice and support at affordable rates.

Our Corporate Insolvency Services

If the debt is becoming a hurdle too big to climb and you are concerned that you may be trading insolvent, it is time to receive professional advice. Legal obligations and insolvency documents should not be ignored. Speak to an insolvency expert today.

Our Corporate Insolvency Process

Specialist advice from industry professionals at an affordable price. Australian Debt Solvers is a team of insolvency specialists that provide personalised service. It all starts with speaking to someone from our team.

5 Steps

Contact Us

The first step to finding a solution to your financial problems is contacting Australian Debt Solvers. We can appreciate that the decision to seek expert advice can come at any time of the day.

That is why we are available 24/7 via the Live Chat service on our website. Getting in contact with our friendly customer support consultants has never been easier. A free consultation can be arranged and undertaken over the phone or face-to-face at one of our many office locations Australia wide.

For those who prefer to pick up the phone and dial, it is as easy as calling 1300 701 206. Australian Debt Solvers can provide the assistance required to deal with your financial problems.

Why Australian Debt Solvers?

Recognising that you are experiencing financial distress can be extremely difficult which is why it is essential to seek professional advice. At Australian Debt Solvers, we provide insolvency services for corporates, companies, and businesses.

We provide the following services: Company Liquidation, Voluntary Administration, and Receivership along with Restructure and Turnaround advice.

Meet Our Insolvency Specialists

A large team of industry professionals is what makes Australian Debt Solvers a market leader in corporate insolvency. Our team comprises of Insolvency Practitioners that ARITA Professional Members, CA and CPA Accountants.

Getting professional financial advice has never been easier. Contact our experts via 24/7 Live Chat, phone, email, or at one of our many office locations Australia wide.

Find an Office

On delicate matters, there is nothing quite like putting a name to a face. With Australian Debt Solvers, you can do exactly that as we provide insolvency services Australia wide. We have offices in all major cities with insolvency specialists on hand to assists with any financial complications. Speak to one of our specialists via phone or make an appointment to meet one of our insolvency experts in person.

Corporate Insolvency Resource Centre

At Australian Debt Solvers, we do more than just provide solutions for financial problems. We have taken it upon ourselves to provide educational material on all areas of corporate insolvency including liquidation, voluntary administration, and receivership. Take the time to explore our Research Centre and expand your knowledge.

Corporate Insolvency Latest News

Wondering what is happening in the world of corporate insolvency? Find out about any recent legislative changes and how they make have an impact on your business. Stay ahead of the curve and up to date with the latest corporate insolvency news.

Corporate Insolvency FAQs

Read about our most common Corporate Insolvency questions and answers.

This is the most common question asked but the reality is that being charged with insolvent trading is rare. It is a complicated and costly action for a liquidator to pursue and there needs to be strong evidence of insolvent trading.

The best course of action is to get on the front foot early and get professional advice. Your focus should not be on whether you will be charged for insolvent trading, but rather on how to regain financial control and stability. Read More

If you have been served with a Statutory Demand, you have 21 days to act. Your main options are:

- Pay the debt

- Have the statutory demand set aside

- Go into a payment plan to pay the debt

- Do not pay the debt

Failure to pay the debt could lead to a Wind-Up notice. Those who are unsure of what to do should contact Australian Debt Solvers for a free consultation.

For additional information, Read More

A Director Penalty Notice gives you 21 days to act. This is regarding any outstanding PAYG or Superannuation Guarantee Charge debts. It is important to note that the 21-day period starts from the date on the notice and not from the day that you receive it. A failure to pay the notice could result in the company being placed in liquidation or voluntary administration. A Director Penalty Notice should no be disregarded or taken lightly. Directors should also be aware that payment arrangements can always be made with the ATO.

Indicators of insolvency can be seen across a number of key business areas including assets, liabilities, equity and reporting. They may include, and are not limited to, any of the following:

Assets

- Company debts outweigh assets.

- Assets have been sold off.

- Liquidity ratio below 1 – insufficient current assets to meet current liabilities when payable.

Liabilities

- Payments to creditors that are not reconcilable.

- Special arrangements and payment plans with creditors.

- Unpaid creditors.

Bookkeeping/Reporting

- Overdue taxes.

- Inability to create accurate reports and make reliable forecasts.

Equity

- No access to alternative finance.

- Inability to raise further equity capital.

- Unable to borrow further funds from current bank.

Read out Insolvency Guide for further information.

The government has made changes to insolvency laws to help small businesses. This includes creating a Simplified Liquidation and Small Business Restructure process. These have been specifically designed for small businesses who have liabilities of less than $1 million. Find out if you are eligible.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5