Custom financial advice in Melbourne to help you manage insolvency and move forward with confidence.

Australian Debt Solvers offers professional advice and comprehensive financial services delivered with expertise. Get in touch today.

Get a Free ConsultationMelbourne Contact Details

Australian Debt Solvers works with clients in Melbourne and across Australia. We have offices around the country, including an office in the heart of the Melbourne CBD. You can contact us directly via our website, call us on 1300 789 499 for a free consultation, or visit us in person at Level 16, 90 Collins Street, Melbourne CBD.

- Level 16, 90 Collins Street, Melbourne CBD

- Call now: 02 8324 7463

Get Your Free Consultation on Insolvency

Insolvency is the state of being unable to pay your debts. Australian Debt Solvers specialises in insolvency cases, including cash-flow insolvency and balance-sheet insolvency. If you're looking for clear advice and practical solutions, we can help you to consolidate your debts and manage your financial obligations with clarity.

If you're struggling with insolvency, it's important to access professional knowledge and expertise so you can make the right decisions. Early intervention is critical, with our expert advisors offering valuable guidance and practical solutions to individuals and businesses across Melbourne.

We can help you to understand your current financial situation and move forward with a working knowledge of your rights and responsibilities. Our advice aligns with industry standards and guidelines from the Australian Financial Security Authority (AFSA). If you're currently facing insolvency in Australia, please contact our team for a free consultation today.

Send a Direct Message

Our Approach To Financial Success

Australian Debt Solvers offers a comprehensive range of financial solutions in Melbourne. Communication and attention to detail are central to our approach, with each case and client offered our full time and respect. We know that each financial situation is unique, and we take the time to identify solutions and recognise new opportunities for growth.

At Australian Debt Solvers, we combine expert financial knowledge and industry experience with a solid work ethic and uncompromising attitude. We have helped thousands of clients in Melbourne and across Australia to understand and overcome their financial challenges. If you need financial insights and advice during a difficult time, please watch our video.

Research About Insolvency

Whether you're a large company, a sole trader, or an individual, insolvency can be challenging to manage and overcome. From cash flow problems to balance sheet discrepancies, expert advice is needed to manage and mitigate the negative effects of insolvency. If you need help during difficult times, Australian Debt Solvers offers friendly advice and tailored financial solutions based on your unique financial situation.

At Australian Debt Solvers, we have experience dealing with a wide range of insolvency cases. The consequences of insolvency differ widely based on assets, cash flow, and business structures, with the severity of the problem also affecting the available solutions. We deal with a wide range of insolvency cases in Melbourne, including cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency - This situation occurs when assets are available to pay off debts, but these assets are not liquid in nature. Balance-sheet insolvency - This situation occurs when there are no available assets to pay off debts, which can result in bankruptcy.

We have successfully managed countless insolvency scenarios across industry sectors, including construction, mining, property, manufacturing, tourism, retail, and hospitality, among others. Along with expert financial advice, we offer an online knowledgebase focused on insolvency and other financial matters.

Please take a look at our Research Centre if you would like to learn more about insolvency and how it affects your situation. The ADS Research Centre is a fantastic asset when you need to make the right decisions for your financial future.

Why Should Your Business Invest in Legal Advice?

When it comes to starting a business or owning one, seeking legal advice should be one of the essential things you do. Having a business lawyer in your corner allows you to freely seek legal advice – allowing you to successfully run your business and manage employees, as well as ensure that your business is compliant with the various laws and legal obligations that apply to run it legally and ethically.

Read more

How to Close a Business When Insolvent

If your business is unable to repay its debts, it could be insolvent. Closing a business can be a complicated and emotional time, but insolvent trading laws means directors should understand their options and make a decision as soon as possible. Seeking advice from insolvency professionals can make the process easier, help you stay fully compliant with the law throughout the process, and help you avoid unwanted surprises.

Read more

10 Signs Your Business is in Trouble

Not every business endeavour is a straight path to success, and even some of the most successful ventures of all time have had periods where ends barely meet, or the future of the company might be in jeopardy.

Instability in business is a facet of life, and recognising the tell-tale signs is vital to not let your hard work slip away into nothing.

Find an Office

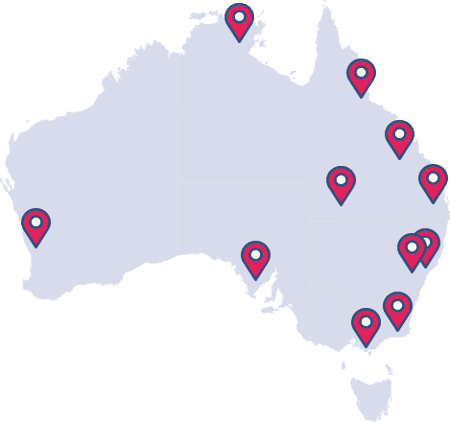

Australian Debt Solvers are experts in helping people through potential bankruptcy and insolvency across Australia. Find the closest office to you:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5