Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

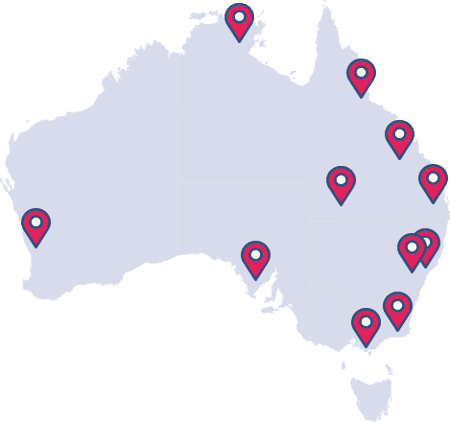

National Network

Officers across Australia

New Reforms Could Save Your Business

Australia's insolvency framework is continuously evolving with the government making significant changes that will support more small businesses to survive. The reforms which were introduced on 1 January 2021 have been designed to provide better outcomes for businesses, their employees, creditors, and the economy.

Our team of experts have a comprehensive understanding of the reforms and how your business can use them to create a financially stable future.

Rated 5 Out of 5

What Is Small Business Restructuring?

It is a simplified debt restructuring process specifically introduced for small businesses. It has been designed to provide a cost effective way in which businesses with less than $1 million in liabilities can continue trading under their current owners.

The streamlining of the current voluntary administration process will limit the cost and reporting obligations of small businesses while they attempt to implement a restructuring plan.

Benefits Of Simplified Debt Restructuring

Use the time required to stay in control of your business and implement a successful restructuring plan.

Simplified Debt Restructuring Process

Not only are a large number of businesses eligible, a restructuring practitioner will assist with developing a debt restructuring plan.

Stay In Control

Company stays under the control of its directors who may undertake transactions that in are in the ordinary course of business while a plan is developed and proposed.

Time Is On Your Side

Extended relief from liability for trading while insolvent giving you the time required to access the restructuring process.

Small Business Restructuring Process

A small business restructure no longer has to be lengthy or complex. Save your business in just five simple steps.

5 Steps

Eligibility

To be eligible, you must:

- Be incorporated under the Corporations Act

- Have liabilities totalling no more than $1 million

- Unable to repay debts within 12 months and facing insolvency

- Not already subject to an insolvency administration

Am I Eligible For Simplified Debt Restructuring?

- Is your company incorporated under the Corporations Act?

- Are your total liabilities less than $1 million?

- Do you have less than 20 employees and are facing insolvency?

If you are not already subject to an insolvency administration and your answer to all of the above is 'YES', you are likely eligible to access a simplified business restructure.

Expert Knowledge and Professional Advice

The debt restructuring has been simplified to help small businesses in more ways that one. Not only are they able to gain access to expert assistance via a small business restructuring practitioner, the streamline process keeps cost to a minimum regardless of the outcome.

Our in-house team of liquidators and restructuring practitioners, are able to make the restructuring process even faster. As a professional insolvency and restructuring firm, we can guide you through the entire process.

Find an Office

The road to a stable financial future is within reach with our specialist team members available 24/7 via live chat. Alternatively, you can arrange to meet an industry expert in at one of our offices across Australian or at a location convenient to you. Let's work together to ensure a better future for your company.

Business Advisory Resource Centre

Want to learn more about insolvency and restructuring? Check out our resource centre for in-depth articles written by industry experts.

Business Advisory Latest News

Changes to insolvency framework regarding small business is an excellent example of why it is essential to be well informed of latest industry news.

Small Business Restructuring FAQs

Need help with small business restructuring? Here are some of the most frequently asked questions that our team receive.

It is the streamlining of the current voluntary administration process introduced specifically for small businesses. Company directors remain in control while they work with a restructuring practitioner to develop and implement a restructuring plan.

- Incorporated under the Corporations Act

- Have liabilities totalling no more than $1 million

- Unable to repay debts within 12 months and facing insolvency

- Not already subject to an insolvency administration

Full details of the eligibility criteria can be found on the ASIC website. Click Here

Once a restructuring practitioner is appointed, the company and practitioner have a period of 20 business days to develop a plan and supporting documentations for creditors.

Following the presentation of the plan, creditors will have 15 businesses to accept or reject the proposal.

YES. This is one of the major benefits of the insolvency reforms. Not only do the directors remain in control, they may undertake transactions that in are in the ordinary course of business while a plan is developed and proposed.

In addition, any debts incurred following the company entering a restructure are not included in the plan.

Despite no two scenarios being the same, the streamlined process attracts a very reasonable flat fee. More importantly, the expert advice provided by the restructuring practitioner could be vital in the survival of the business. In the event that a restructure is not possible, you will like be eligible for a low-cost simplified liquidation.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5