We offer expert financial advice in Perth on personal bankruptcy to help you to manage, avoid, and improve outcomes.

Get in touch today with Australian Debt Solvers for expert, professional advice and comprehensive financial services.

Get a Free ConsultationPerth Contact Details

Australian Debt Solvers work with clients across Perth and wider Australia. You can find our Perth headquarters in the heart of the CBD, at Level 14, 197 St Georges Terrace, Perth CBD. Alternatively, you can email us via our website, or call us on 1300 789 499 for a free consultation.

- Level 14, 197 St Georges Terrace, Perth CBD

- Call now: 02 8324 7463

Personal Bankruptcy Free Consultation

When dealing with the possibility of personal bankruptcy, you’ll need reliable financial assistance and clear, honest advice.

Legally, personal bankruptcy occurs when someone cannot pay off their debts of $5,000 or more. Bankruptcy can be initiated by debt collectors, creditors or solicitors and can cause serious problems. Bankruptcy can often create additional financial challenges, despite releasing you from many debts, and so it's best treated as a last resort.

We can help you to get control over your finances, through expert consultation and friendly guidance. Australian Debt Solvers help you overcome challenges and move forward confidently. If personal bankruptcy is a likely possibility for you in Australia, get in touch for financial advice today.

Send a Direct Message

How We Approach Financial Success

Are you going through a difficult time financially? You need financial advice and practical solutions. Our expert knowledge paired with industry experience will help you to achieve financial success.

We have helped countless people and businesses to overcome their financial challenges, with clients located across Perth and throughout Australia. Watch our video to find out more about how we can support you on your financial journey.

Personal Bankruptcy Research

Australian Debt Solvers are extremely experienced with personal bankruptcy cases of varied situations. Our expert advisors ask the right questions to help you to manage, avoid, and overcome bankruptcy smoothly. Bankruptcy can be voluntary or involuntary, we offer custom solutions for both situations, tailoring our expert advice for your personal financial situation.

Our expert team is on your side, offering support with your personal bankruptcy. The complex debt agreements and stress of debt collectors can be overwhelming. We’re here to help you find the right solutions, specialising in the following areas: creative debt solutions, financial and legal consequences of bankruptcy, asset management, taxation advice and obligations, debt consolidation, debt management.

We support you in managing personal bankruptcy demands with experience and clarity. We also help you to make considered decisions based on years of industry experience. If you would like to learn more about personal bankruptcy and your rights, access our extensive resource of online knowledge at our Research Centre. Move forward with clarity with industry insights, practical tips, and expert guidance. Get in touch with ADS today.

10 Ways to Turnaround Your Struggling Business

If your business is struggling, you may not know the best way to fix the problem without some help. We’ve put together 10 ways that you may be able to use to turn your struggling business around.

If you aren’t sure where to start, contact Australian Debt Solvers online now and speak with the experts about what actions may be needed for your business to become profitable again.

Why Should Your Business Invest in Legal Advice?

Obtaining legal advice is an important part of running your business. As a business owner, there are times where you may need to seek a legal specialist for advice on areas including contracts, debt recovery, business law, insurance, intellectual property, and more.

Read more

How to Bounce Back from Bankruptcy

Insolvency for businesses or individuals is never desirable, but bankruptcy and isn’t the end-all you might think it is. Bankruptcy can be the best way to start on a new path and rebuild your financial foundation. Whether you ran a company or suffered a personal financial setback, you can start rebuilding your financial life today.

Read more

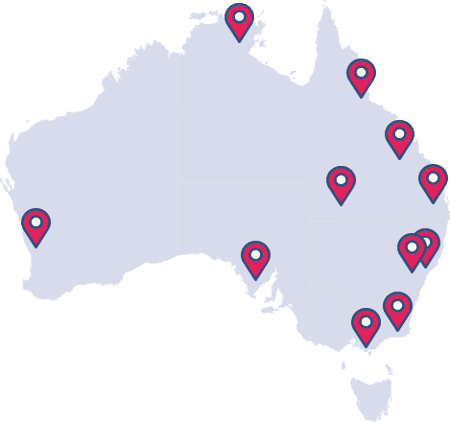

Find an Office

Australian Debt Solvers are experts in helping people through potential bankruptcy and insolvency across Australia. Find the closest office to you:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5