The difference between Bankruptcy and a Personal Debt Agreement

There were 10,621 new personal insolvencies in 2020–21, which was down for the previous year. While there's no doubt Government pandemic financial assistance such as JobKeeper and other COVID packages have helped reduce the economic burden on people, many others will still face the difficult decision to look at personal insolvency options.

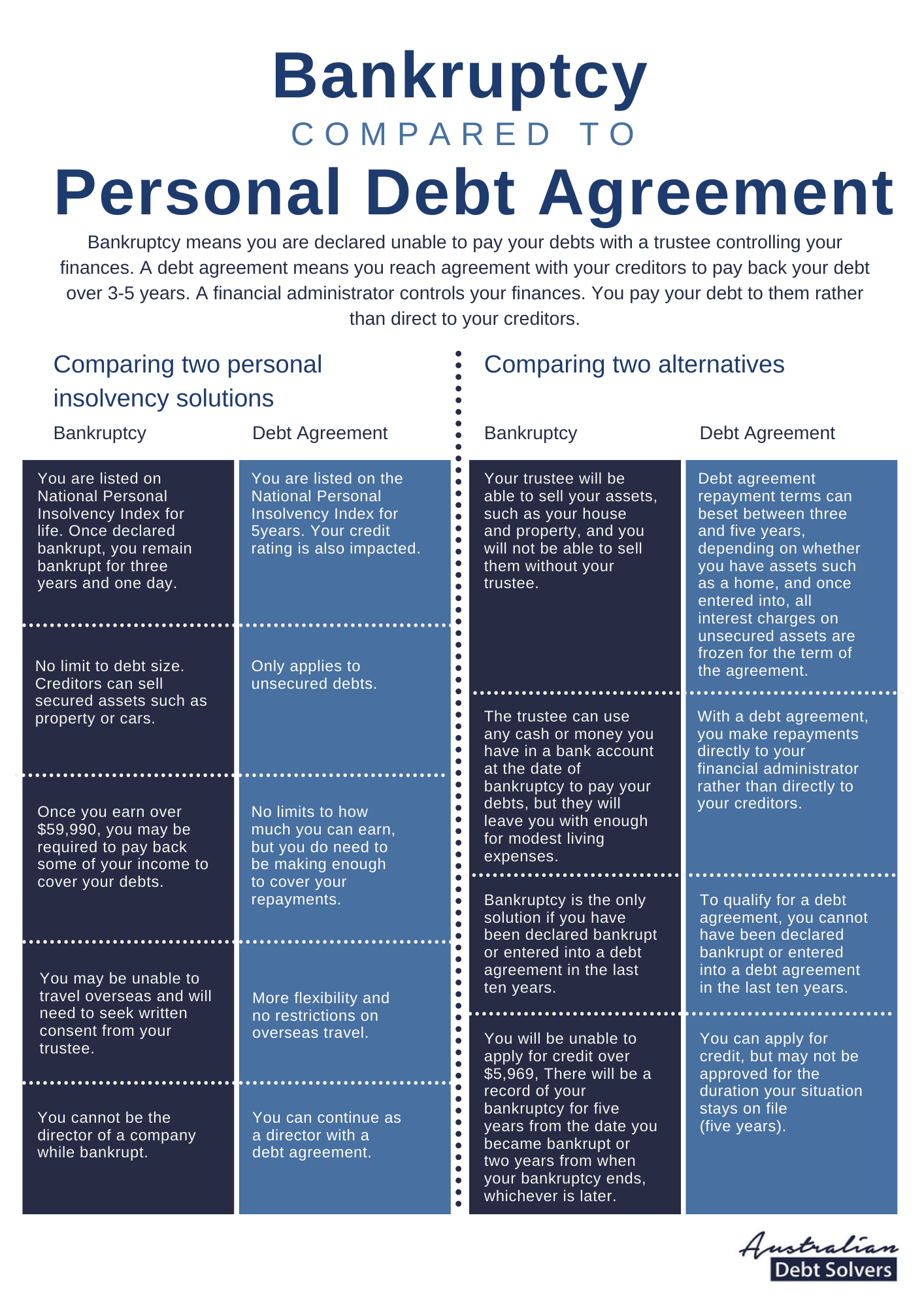

While there are a few options available to manage personal insolvency, a debtor (the person who owes money to creditors) needs to consider whether a personal debt agreement or becoming bankrupt is the better option for them. Each has both similar and different criteria, and it's worth knowing the difference so that you make the best decision for yourself.

The key similarity between bankruptcy and debt agreements is that you cannot meet your debts when payments are due (you are insolvent).

With a debt agreement, you do not need to have a residential or business connection with Australia, whereby with bankruptcy, you're required to be present in Australia or have a residential or business connection to Australia.

A debt agreement means you arrange with your creditors to pay all or a percentage of your debts back over a period of up to five years. Once creditors accept your agreement, a debt agreement administrator manages it, and all payments are made to them rather than directly to your creditors. If you choose bankruptcy, you may not be required to pay back your debts or only pay back a certain amount once your income reaches a certain level. A bankruptcy trustee will administer your estate for three years and one day.

While you may not have to pay your debt back once declared bankrupt, once your earnings exceed $59,990, you may be required to start paying income contributions to your bankrupt estate.

With a debt agreement, your after-tax income for the year must be no higher than $89,339 at the time of making the proposal to your creditors, but there are no limits to how much future income you can earn. You only need to earn enough to cover the repayment amounts in the agreement. Repayment terms can vary between three and five years, depending on your circumstances and what is accepted by your creditors.

A bankruptcy trustee has an obligation to realise (or sell) your assets, such as your house and property, for the benefit of your creditors. They can also recover any money in your bank account to meet your debt obligations (but will leave you with enough for modest living expenses). With a debt agreement, your assets will only be dealt with in accordance with the agreement you have with your creditors. That is, if you said that you would sell your car to meet a payment to the debt agreement, you will be obligated to undertake the sale of the car. Your personal net asset position can be no greater than $238,238.

Once you enter into a debt agreement, all interest charges on unsecured assets are frozen for the agreement term. All creditors are bound to the agreement and cannot pursue you for the balance of debt (if any) once the agreement ends.

Bankruptcy has no limits to debt size, whereas a debt agreement is only available if your unsecured debts add up to a limit of $119,119.

Once declared bankrupt, you cannot serve as the director of a company nor travel overseas without written consent from your Trustee. A debt agreement does not hamper your role as a company director, and you are free to travel abroad.

Once declared bankrupt, you will be unable to apply for credit over $5,969, and there will be a record of your bankruptcy for five years from the date you are declared bankrupt or two years from when your bankruptcy ends. With a personal debt agreement, you are free to apply for credit. However, as the record stays on file for five years, there is a possibility it will be declined.

It is important to note that bankruptcy will be your only option if you have been bankrupt or entered into a debt agreement in the last ten years.

Regardless of which option is best for your circumstances, there will be impacts on your credit rating. With bankruptcy, you are listed on the National Personal Insolvency Index for life, while a debt agreement is recorded on the National Personal Insolvency Index for a limited time.

It is advisable to seek independent financial advice when considering these personal insolvency options as soon as you think you will have trouble meeting your financial obligations. A financial adviser will discuss your financial affairs and circumstances with you and provide advice on the best option for you and help get you back on track sooner.

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5