Registered by ASIC

Liquidators

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

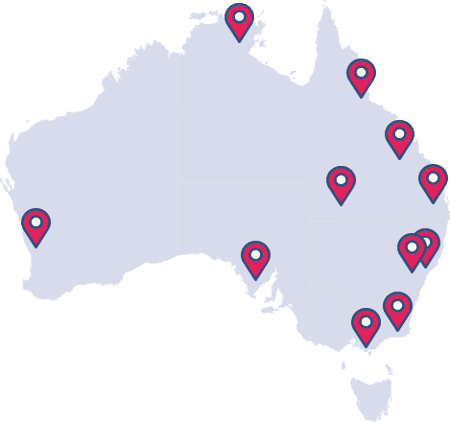

National Network

Officers across Australia

Why Australian Debt Solvers?

As corporate insolvency experts, we deal with struggling businesses on a daily basis. As a result, we have an excellent understanding of the impact that customer trends and changing market conditions can have on businesses of all scales.

There are a number of reasons why a company may decide to restructure. From a business turnaround to sustained success or diversification, Australian Debt Solvers can provide expert advice that will make a difference.

Rated 5 Out of 5

What is Restructure and Turnaround?

Restructuring involves changing the financial and/or operational aspects of a company. This usually occurs at times of financial pressure and distress. It may also take place when a company is preparing for a significant financial transaction in the form of a sale, merger, or transfer of ownership.

Depending on the circumstances, specific courses of action are required. They may include debt consolidation, cost reduction or company restructure among other things. Key decisions are then made to promote business turnaround and improve the state of the company.

Restructuring Services and Business Turnaround

There are several options available with respect to restructuring. Our experienced team of professionals can provide 'hands-on' advice in key areas.

Strategic Advice & Planning

An ineffective business plan or unforeseen changes can have an adverse impact on any organisation. Our experts can accurately identify any issues and provide an updated plan that will help restore success.

Financial & Operational Restructuring

With accounting and leadership professionals as part of our expert team, we can help improve your bottom line without disrupting your business. This includes job and debt restructuring along with operational changes.

Cash Flow & Working Capital Management

Even the strongest business models can suffer from insufficient cash flow or a lack of working capital. Our team of financial analysts can help you identify opportunities to improve your cash flow and manage your capital better.

Our Restructure and Turnaround Process

Ignoring the need for change can be detrimental to any business. It may be that minimal changes are required to help turn things around. Exploring potential options can be achieved in a timely and cost-effective manner thanks to our seamless restructure and turnaround process.

5 Steps

Evaluation

Once employed for the purpose of restructuring and turnaround, the first step of our team is to conduct a thorough financial and operational evaluation. This is done in order to properly assess the current state of the business.

It is not as simple as looking at the books. During the process, our in-house team of accounting, leadership, and business professionals will maintain open and honest lines of communication with key stakeholders. This is done to ensure that an accurate assessment is made in an efficient and timely manner.

Why Australian Debt Solvers?

Choosing to restructure your company is one decision, but employing the right professionals to assist is even more important. At Australian Debt Solvers, our team of experts will work alongside you in order to determine the right course of action.

After conducting a thorough and honest assessment of the company, a detailed report and subsequent restructure plan will be provided. The restructure seeks to streamline and optamise company processes with the aim to improve profit margins through efficiency. Speak to one of our experts today.

Meet Our Restructure and Turnaround Professionals

Restructuring requires expert knowledge across a range of key areas. Our team consists of specialists across a range of fields including accounting, leadership, consolidation, operations and technology.

Australian Debt Solvers clients get hands-on access to our in-house insolvency professionals including ASIC registered liquidators and ARITA members, who will help formulate a strategy that will secure a stronger future for your company.

Find an Office

Our restructuring and business turnaround services are easily accessible Australia wide. We know the importance of working together towards a better future which is why our expert professionals are available in all major cities. Don't wait until it's too late. Let's work together to ensure a better future for your company.

Restructure and Turnaround Resource Centre

Does restructuring sound like a mountain too big to climb? Our Resource Centre has detailed information from industry professionals on how business restructuring can help get things back on track.

Restructure and Turnaround Latest News

Keep up to date with the latest news and real life case studies on companies that have used restructuring services to help secure their future.

Restructure and Turnaround FAQs

Read about our most common Corporate Insolvency questions and answers.

Business restructuring typically involves reorganising the legal, ownership, operational, and/or other structures of the company. The purpose of such could be to increase profitability, but more often than not it is to avoid insolvency and debt issues.

To increase the prospects of a successful turnaround, companies often employ an external third party such as Australian Debt Solvers to provide expert advice and recommendations.

As part of our restructure and turnaround process, we will:

- Conduct a thorough evaluation

- Identify strength, weaknesses, opportunities, and threats

- Provide recommendations

- Help implement recommendations

- Work alongside you, reviewing results and monitoring strategies

Read more about you business restructure and turnaround options.

There are several different reasons why a restructure should be considered. This may be the case early in the business cycle during a period of rapid growth or at a more mature stage where there is a potential change in ownership. Here are some of the most common reasons for business restructuring:

- Change in management or ownership

- Stagnating profit growth

- Poor efficiency

- Incompetent management

- Shifting customer base

- Business growth or economic downturn

For more information, read our in-depth article on ‘when should a business restructure be considered?’

The key to a successful restructure is developing an effective strategy. The easiest way to do this is by seeking professional restructure & turnaround advice from experts such as Australian Debt Solvers. Our team will follow a proven process that will provide the best prospects of returning to financial prosperity. The process includes evaluation, analysis, recommendations, implementation, and review.

Read more on how to manage your business operations restructure.

When a company is failing to meet expectations, there are several ways to address the issue. Increasing profits is not as simple as generating more revenue through sales. It is necessary to take a holistic approach and analyse every aspect of the business, both internal and external. Depending on the type of business, the following areas may be considered:

- Company budget: Analysis of everything from salary and expenses to revenue and forecasts. All financial records should be scrutinised.

- Efficiency: The organisational structure and every department in it are to be evaluated to identify issues and areas of improvement.

- Products and Services: An objective evaluation of such shall be conducted including production costs and processes. A rising cost of acquisition may be affecting profitability, as may competition or unpursued opportunities.

At Australian Debt Solvers, our team consists of specialists across a range of fields including accounting, leadership, consolidation, operations, and technology. If you are looking to increase your profits, contact us for expert advice that will make a difference.

The government has introduces a simplified debt restructuring process specifically for small businesses. It has been designed to provide a cost effective way in which businesses with less than $1 million in liabilities can continue trading under their current owners.

It is a simplified process that is more cost-effective, allows company directors to remain in control, and provides them with the time required through extended relief from liability for trading while insolvent.

Find out if your company fits the criteria for a small business restructure.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5