AFSA Registered

Trustee

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

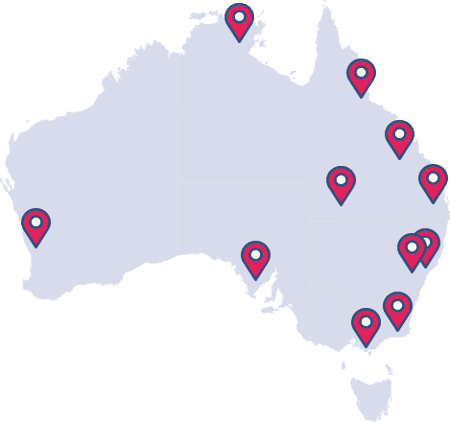

National Network

Officers across Australia

Personal Bankruptcy Advice You Can Trust

The thought of personal bankruptcy can be daunting. One of the biggest issues is a lack of knowledge and a limited understanding of the bankruptcy proceedings. At Australian Debt Solvers, we have in-house AFSA Registered Trustees who lead a team of professionals that can provide you with expert advice and manage your bankruptcy.

Our specialists have the experience required to provide care and empathy in a time of need. We will guide you every step of the way, and complete the process quickly in order to relieve any stress.

Rated 5 Out of 5

Is Personal Bankruptcy the Right Option?

If you are struggling with personal debts, Voluntary Bankruptcy might be the most suitable option.

Contrary to what many people think, in many cases declaring bankruptcy does not mean that you ‘lose everything’. Voluntarily filing for bankruptcy provides more options and prevents a court or creditor forcing you into bankruptcy.

Personal Bankruptcy

If you no longer have control of your finances there are actions you can take under the Bankruptcy Act 1966. Our experts can help you file for personal bankruptcy, relieve you from the pressure of repayments within days, and put you back on the path to financial stability.

There are two main types of bankruptcy - 'With Assets' and 'Without Assets'

Bankruptcy With Assets

Subject to permission from your trustee, you do not have to lose your home and you can still retain a car. Find out how!

Bankruptcy Without Assets

Straightforward. Your trustee will total your debts, advise your creditors and outline your financial commitments moving forward.

Why Australian Debt Solvers?

At Australian Debt Solvers, our aim is to reduce financial distress by providing bankruptcy solutions. We are well aware that no two scenarios are the same which is why it is necessary to get expert bankruptcy advice.

Knowledge and experience have allowed our team of professionals to form a process that ensures a better future for our clients. We can assist with your financial challenges and make your financial position more manageable.

Meet Our Bankruptcy Professionals

At Australian Debt Solvers, we are in the business of helping people who are in financial distress. We do what we do to help people through the situation they are in, to a better outcome – whether they are a Director of a multi-million dollar company or struggling to make ends meet with their personal finances.

Meet the teamEnquire now

Personal Bankruptcy Australia Wide

Australian Debt Solvers is a national firm with the ability to provide a personal service. Our team specialise in helping people through potential bankruptcy and insolvency. Contact your closest office to arrange a free consultation.

Personal Bankruptcy Resource Centre

Want to learn more about Personal Bankruptcy? Read the Australian Debt Solvers Resource Centre which features in-depth articles written by industry professionals.

Personal Bankruptcy Latest News

As a leading bankruptcy company, we have access to the latest insolvency information. Stay up to date with industry news and read articles written by bankruptcy business experts.

Personal Bankruptcy FAQs

Some of the commonly asked questions when it comes to Personal Bankruptcy.

Bankruptcy is the legal process of declaring that you are unable to pay your debts. Most debts are covered but bankruptcy does not release you from all debts.

It is important to understand the consequences of bankruptcy as it may affect your ability to get credit, prevent you from traveling, or hinder your ability with respect to some types of employment.

Outside of any administrative costs, there is no cost associated with applying for bankruptcy.

Most debts are covered including credit cards, unsecured personal loans, utility bills, and any unpaid rent. Bankruptcy does not cover court-imposed penalties, any child support payments, student loans, or any debts accrued after bankruptcy begins.

There is a distinct difference between domestic and international travel for those who have declared bankruptcy. There are no restrictions on domestic travel meaning you can move freely around Australia and its territories. However, there are restrictions with respect to international travel. If you wish to travel or move overseas you must first seek approval. You must contact your trustee and go through the application process. Fees and charges will apply.

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5