Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

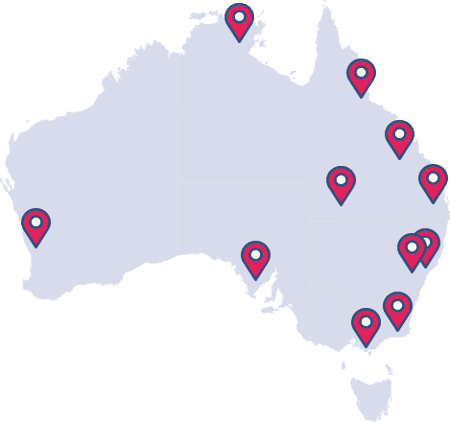

National Network

Officers across Australia

How To Get Back On The Right Path?

Challenging global economic conditions have placed significant strain on small businesses. Dealing with financial stress is no easy task, which is why it is essential to speak to an expert.

At Australian Debt Solvers, we have a team of professionals who can effectively asset the state of your business and provide clear advice. You will be able to speak directly to an industry expert you can guide you back on to the path of financial prosperity.

Rated 5 Out of 5

What Is Simplified Liquidation

In response to global economic pressure, the federal government has made changes to insolvency laws. This includes creating a Simplified Liquidation process that is specifically designed for small businesses.

It is a shortened version of the Creditor's Voluntary Liquidation (CVL) which can be accessed by businesses that have liabilities of less than $1 million. The process is significantly faster than a normal CVL at provides a more cost-effective methods for businesses to liquidate.

Benefits Of Simplified Liquidation

The streamlined process has been cut back to offer small businesses an easier pathway to liquidation.

Lower Cost

A simplified process means fewer legal requirements and a faster liquidation. This minimises the workload of a liquidator and decreases the normal cost.

Effective Communication

The liquidator can now communicate with creditors online through email and web portals. Along with the removal of meeting requirements, a more effective communication process has been created.

Less Reporting To ASIC

A liquidator is now only required to report to ASIC where there are reasonable grounds that misconduct has occurred, and that the conduct has has a significant impact on creditors.

Am I Eligible To Access Simplified Liquidation?

- Do your company liabilities exceed $1 million?

- Is your company able to pay its debts within 12 months?

- Has you company undergone restructuring or been subject of a simplified liquidation within the last 7 years?

- Does your company have any outstanding tax responsibilities?

If your company is seeking a simplified liquidation and your answer to all of the above is 'NO', contact us today.

Expert Knowledge and Professional Advice

Courtesy of and in-house team of liquidators, we are able to make the simplified liquidation process even faster. There is no need to communicate with external parties and you are able to access a personal service from the first point of contact.

If you are going through a difficult time and think that your business may need to liquidate, speak to one of our experts who will provide you with the right advice.

Find an Office

With offices throughout Australia and a dedicated online team, you can speak to one of our specialists 24/7 or arrange to meet with one of our industry professionals in person. As part of our service, we can arrange for one of our experts to come and see you. Don't wait until it's too late. Contact us today.

Liquidation Resource Centre

Want to learn more about Company Liquidation? Check out our resource centre for in-depth articles written by industry experts.

Liquidation Latest News

The introduction of simplified liquidation is a great example of why it is important to stay up to date with the latest news. Knowledge of changes in legislation or regulatory requirements can help save your business.

Simplified Liquidation FAQs

Still don't have a handle on simplified liquidation? Here are some of the most frequently asked questions that our team receive.

Simplified Liquidation is a shortened version of the Creditor's Voluntary Liquidation (CVL). It has been specifically designed to alleviate financial stress placed on small businesses and provide them with a cost-effective path to liquidation.

There are three basic elements to the simplified liquidation criteria. They are:

- Restricted to companies seeking a creditors voluntary winding up

- Liabilities must not exceed more than $1 million

- The company is unable to pay its debts in full within a 12 month period

Full details of the eligibility criteria can be found on the ASIC website. Click Here

The differences can be broken up into three distinct areas:

Communication: The requirement for creditor meetings have been removed, as has the ability to form committees of inspection. A liquidator can now communicate with creditors online through email and web portals.

Reporting: A liquidator is now only required to report to ASIC where there are reasonable grounds that misconduct has occurred, and that the conduct has has a significant impact on creditors.

Cost: A simplified process means fewer legal requirements and a faster liquidation. In addition, the removal of meeting and postal requirements have decreased the amount of administration work required to be carried out. This minimises the workload of a liquidator and decreases the normal cost.

The Simplified Liquidation process came into effect on January 1, 2021. It was in response to global economic pressure and the expectation that it would results in a substantial amount of liquidation applications.

The streamlined process and removal of several liquidator requirements has cut the cost of liquidation significantly for small businesses. The exact cost will vary on the size of the business but and average simplified liquidation will cost between $3,000 to $6,000.

We care about our customers

At Australian Debt Solvers, we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5