Tax Advice for Small Businesses from Accountants

You’d be hard-pressed to find a small business owner that doesn’t start pulling their hair out at the mention of taxes. They’re notoriously boring and difficult, with a thousand considerations, loopholes, and things that you could technically be doing better.

Unless you’re a small accounting business, there’s probably little chance that you’re fully adept at wringing the best deal possible out of the system, which is by confusing by design- to stop you from doing that exact thing.

In order to help you out come crunch time, we’ve asked a couple of the pros to give us some sure-fire tips on how to stave off the tax man’s mitts come July.

Cash is still king, even at tax time

According to Mitchell Turnbull, Director of Bridgepoint Group, if you wouldn’t have spent it before, you shouldn’t have rushed out to spend it simply because the Government was offering write-offs for assets less than $20,000 or because OfficeWorks was running a promotion on TVs telling you to spend more before 30 June.

Cash flow is always crucial to small businesses and any excess spending prior to 30 June may have created ramifications on cash-flow in these later months. Ensure you take your current and future situation into consideration before committing to cash spend at any time.

Compartmentalise the running of your business

One of the hardest things about running a small business is having to be everybody at once. You have to be the owner, the manager, and the worker- all bundled into one (sometimes) nerve-wracked being.

Small business owners often find themselves seemingly without time to do their accounts, or working on admin tasks- there are customers to attend to, orders that need filling, and potentially a store that needs running to boot!

The main problem here is that a lot of small businesses end up with a bunch of administrative backlog and worries at the end of the financial year. Do yourself a favour and remove yourself (no matter how busy you are) from proceedings once in a while to concentrate on it. You’ll thank yourself later, trust us.

Learn to start compartmentalising your different roles within a company, and don’t let them merge too much. Spend some time as a manager, and some time as an accountant. The more distinct these roles are, the easier you’ll find switching between them, and the easier it’ll be to get down to brass tacks and do them when they’re needed. The last thing that you want is to forget a receipt for a major expense or fail to lodge your accounts regularly.

Business and personal finances stay split

The second administration nightmare that arises from not having a clear distinction between your business and personal life is the common trap of sharing too much personal finance in with the finance of your business.

This is technically fine- it’s your money, after all- but come tax time you’re going to be spending a lot more time than it’s worth pulling stubs and receipts out of storage to differentiate one from the other.

This is another issue that compartmentalisation can help with. Keep a separate bank account that’s never, except under extreme circumstances (or for large purchases that you can easily earmark), to be used for personal things.

Simple deduction, Watson

Did you know that the Australian Tax Office has an app that allows you to figure out deductions? Discovering that you’re eligible for a monetary deduction come tax time is a joyful moment and one that you should be aiming for at every convenience.

The app allows you to lodge your taxes, record expenses/ gifts/ deductions throughout the year, check salary and wage withholding, and remind you about key dates.

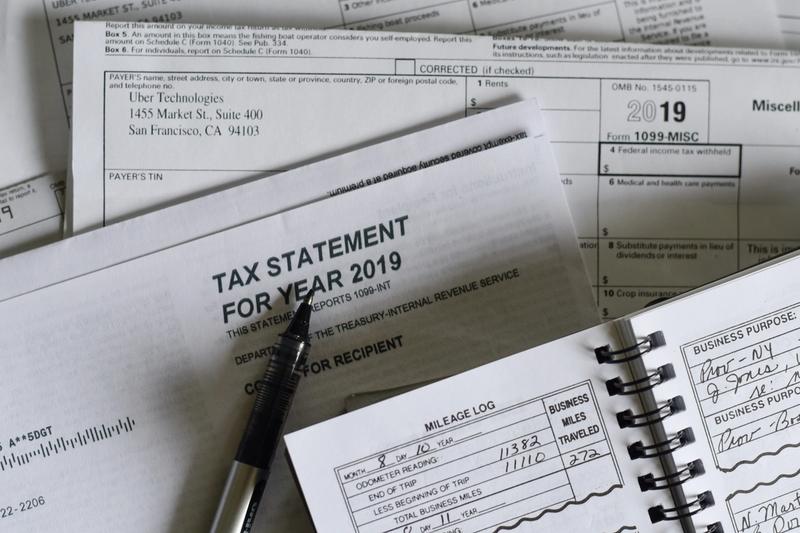

On that note, there’s also myDeductions, another ATO effort to keep your deductions simple and easy. It even has a car trip recorder, with three separate methods of tracking distance- GPS, Point-to-point, and through an Odometer.

Leave it to the professionals

Unless you’re a tax wizard, there are still a couple of compelling reasons to leave your business dealings in the hands of a registered accountant. Even with the wealth of information out there, finding the correct deduction or the right form in the midst of bureaucracy can be near impossible if you haven’t made a career out of it.

Accountancy isn’t overly expensive, and it can save you more than its cost in both the security of knowing that your accounts aren’t going to have mistakes and in knowing that you’re taking advantage of every possible angle available to you.

It’ll also help with the first major point that we brought up- the idea of having to work as multiple roles in business leaving you with no time to do them all properly- in order to give you more time, save you money, and give you peace of mind.

Give yourself some credit

Small businesses can get tax credits for switching over to renewable energy sources. If you’re not hurting for power, consider installing a solar panel system on the roof of your location(s)- it’ll help the environment, foster a little community goodwill, and give you a nice enough tax credit to boot.

The only real reason to avoid it would be if the way that you conduct business requires an inordinate amount of energy. If this is the case, you can still supplement with solar paneling, especially for services that usually aren’t used for commercial purposes in most conventional offices, such as hot water.

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5