Financial advice for managing and overcoming liquidation in Perth.

Australian Debt Solvers are insolvency specialists that can help overcome any of your financial challenges.

Get a Free ConsultationPerth Contact Details

Australian Debt Solvers national presence includes a dedicated office in the heart of Perth. You can find our Perth headquarters at Level 14, 197 St Georges Terrace, Perth CBD. Alternatively, you can email us, speak to one of our specialists via live chat on our website, or call us on 1300 789 499 for a free consultation.

- Level 14, 197 St Georges Terrace, Perth CBD

- Call now: 02 8324 7463

Book Your Free Liquidation Consultation

During the liquidation process it is essential to be aware of your rights, obligations, and legal responsibilities. Liquidation is a challenging process that we aim to make stress-free for our clients by using our comprehensive industry experience.

Australian Debt Solvers can provide expert advice and practical solutions that will help minimise your losses. Having a team of in-house liquidators ensures that the process is completed in a timely and cost-effective manner while carrying out all your legal responsibilities. If your Perth business is facing liquidation, contact us for a free consultation.

Send a Direct Message

How We Approach Financial Success

The burden of financial stress on a business cannot be underestimated and we can appreciate that more than most. Australian Debt Solvers has helped countless businesses in Perth and across Australia by identifying issues, addressing them, and creating a path to a stronger economic future.

One of the keys to success is utilising the options available. If you are experiencing financial distress, it is essential to act quickly as there could be additional options available. Don't wait until it is too late and get trusted financial advice that will have a positive impact. Our expert knowledge industry experience will help you to achieve financial success.

Liquidation Services and Research

As one of the leading experts in liquidation cases in Australia we have the knowledge and team to consistently secure the best outcome possible for our clients. We have experience dealing with all business types including sole traders, family run entities, and large scale companies. Not only can we help you through the liquidation process, we can also manage your finances and establish future stability.

We are experienced in dealing with liquidation cases across Perth, including voluntary liquidation and involuntary liquidation. Our team of specialists can assist with all liquidation needs including: compulsory liquidation, petition from contributors, voluntary resolution, creditors’ voluntary liquidation, members' voluntary liquidation, petitions, and the recently introduced simplified liquidation.

Our team comprises of in-house liquidators that are all ARITA professional members and registered by Australian Securities Investments Commission (ASIC). Their familiarity with ASIC regulations and requirements places us in the ideal position to advise our clients accordingly.

To expand your own knowledge about liquidation, use our Liquidation Research Centre which provides insights, expert guidance and answers to a long list of liquidation FAQ.

The Complete Guide to Business Liquidation

The prospects of liquidation can strike fear into any business but if you at quickly, there may be a number of alternative options available to you. This is why it is essential to act quickly if you have encountered financial challenges. A team of experts can assess your financial position and the viability of your business before providing trusted financial advice. To learn more about the fundamentals of insolvency, read through our complete guide to liquidation.

Read more

How Soon After a Wind-Up Notice Do You Have to Cease Trading?

If you have received a wind-up notice from creditors or the ATO, it is imperative that you act accordingly. First and foremost, that means addressing the issue as failure to do so may result in a court winding-up your business in a matter of weeks.

You do not have to stop trading but rather should use the nominated time to obtain professional advice and explore your options. This may include paying the debt or entering a payment plan that is agreed upon by your creditors. Directors should be aware that a wind-up notice is a sign that a business is unable to meet its financial commitments. It is illegal to trade insolvent and directors may be held liable for doing so. Get the help you need today.

What Happens to Employees When a Company Goes into Liquidation?

Employees are one of the main parties affected when a company goes into liquidation. For business owners and employees alike, liquidation is regularly something that none of the parties have any experience with. In comparison, liquidation is something that Australian Debt Solvers specialises in and deals with on a daily basis. As a result, we have comprehensive knowledge on the process and the entitlements of employees.

Employees are entitled to unpaid wages, superannuation, annual leave, and retrenchment. In the event that there are no funds remaining to pay these, they may be able to claim through the Fair Entitlements Guarantee (FEG).

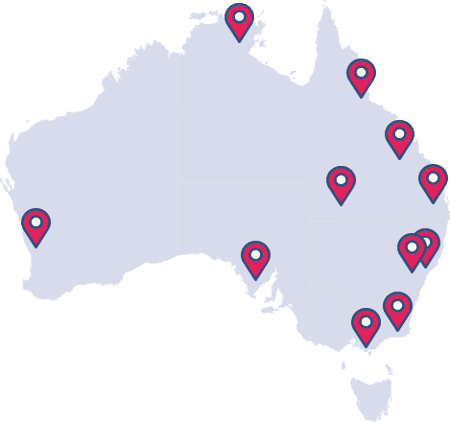

Find an Office

Australian Debt Solvers are insolvency experts that help people and businesses throughout Australia. For professional advice on all matters including liquidation, contact the closest office to you:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5