Expert financial advisory in Melbourne to help you manage the liquidation process.

Australian Debt Solvers offers professional advice and comprehensive financial services delivered with expertise. Get in touch today.

Get a Free ConsultationMelbourne Contact Details

Australian Debt Solvers works with clients in Melbourne and across Australia. We have offices throughout Australia including an one conveniently located in the heart of the Melbourne CBD. You can contact us directly via our website, call us on 1300 789 499 for a free consultation, or visit us in person at Level 16, 90 Collins Street, Melbourne CBD.

- Level 16, 90 Collins Street, Melbourne CBD, VIC 3000

- Call now: 02 8324 7463

Get Your Free Consultation on Liquidation in Melbourne

Going into liquidation is the process whereby a company ceases its operations and proceeds to wind up. The complexities of business and a number of legal obligations throughout can make it a very challenging process. This is why it is important to obtain expert advice from insolvency professionals such as Australian Debt Solvers.

Liquidation is not limited to companies that are trading insolvent and can in fact be voluntary or involuntary in nature. Depending on the financial state of the company, the liquidation process will affect relevant parties in different ways. Understanding legal obligations and the priority of claims can help you get through a delicate process with confidence.

Using our expert services you can ensure a successful liquidation and begin building towards a better financial future. If you need to liquidate your Melbourne business, we offer a free consultation which is accompanied by expert advice. Contact our Melbourne office to arrange a free consultation with one of our liquidation professionals.

Send a Direct Message

Our Approach To Financial Success

Excellent communication and attention to detail has allowed us to assist thousands of Melbourne businesses by providing comprehensive financial advice. We know that every financial situation is unique, which is why we place a large emphasis on working alongside our clients to get a complete understanding of their business and goals. Our experts will take the time required to identify solutions and explore new opportunities for growth.

Our vision is to combine expert financial knowledge and industry experience with a solid work ethic and uncompromising attitude. This mindset has allowed us to help thousands of clients in Melbourne and across Australia to overcome financial challenges. A better and brighter financial future is achievable with Australian Debt Solvers.

Meet Our Liquidators in Melbourne

With insolvency services accessible across Australia, Australian Debt Solvers is committed to helping businesses and individuals handle all insolvency matters including liquidation.

One of our offices is located in the heart of the Melbourne CBD where a team of insolvency specialists are available to provide valuable financial advice. As an industry leader, we are well aware of the stress and economic strain that liquidation can cause. Don't wait until it is too late and make use of our free consultation service today.

Our team consists of in-house liquidators who are registered by ASIC. Their expert knowledge allows them to anticipate any unforeseen issues, ensuring a smooth and stress-free liquidation process. For a personal service and the financial advice required to secure your future, make an appointment for a free consultation with one of our insolvency practitioners or simply visit our Melbourne office located in the city centre.

Liquidation Services and Research

With extensive experience across all areas of insolvency, Australian Debt Solvers have been able to help Melbourne businesses of all sizes with respect to the liquidation process. From sole traders to small proprietary companies and multinational organisations, our success in the industry speaks for itself.

If your business is struggling to pay outstanding debts or meet its financial commitments, our free professional consultation can provide clarity with respect to your financial position and the necessary steps to take. With comprehensive knowledge of ASIC regulations and legal frameworks, our team will advise on the appropriate course of action. We specialise in all forms of liquidation including:

- Creditors’ Voluntary Liquidation

- Members’ Voluntary Liquidation

- Provisional Liquidation

- Simplified Liquidation

For a prosperous financial future, visit our Melbourne office to speak to one of our liquidation experts or explore a range of online materials. Our Liquidation Resource Centre provides, guidance, practical tips, and answers to the most popular Liquidation FAQ.

What Happens to Employees When a Company Goes into Liquidation?

The prospects of administration or liquidation place a burden on a substantial amount of parties, and employees are no exception. In many instances, business owners and employees alike are unaware of their rights, responsibilities, and obligations.

As per legislation, employees are entitled to unpaid wages, superannuation, annual leave, and retrenchment. That said, there is often limited or no funds remaining following the liquidation of assets to pay these entitlements. If this is the case, employees might be able to claim through the Fair Entitlements Guarantee (FEG).

How Soon After a Wind-Up Notice Do You Have to Cease Trading?

If you have received a wind-up notice it is imperative to address the matter immediately. Failure to act within the nominated timeframe (usually 21 days) may result in the court winding up your business.

It is important to note that a wind-up notice does not mean that you must stop trading immediately. Use the time to obtain expert advice which may include entering a payment plan to repay of any debts. Directors should also be aware that insolvent trading is illegal and may result in them being held personally liable. Contact us today to assess your options.

The Complete Guide to Business Liquidation

One of the most powerful tools in business is knowledge. If your business is facing financial difficulties, it is important to understand that there are several options available. This could be the difference between returning to financial prosperity or being force to liquidate, further emphasising the value of professional advice. Given the opportunity, our team will investigate your options and help pave a path to sustained success.

Read more

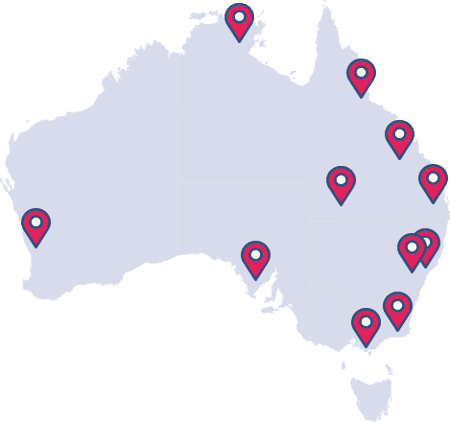

Find an Office

Australian Debt Solvers specialise in helping people with bankruptcy and insolvency matters across Australia. Our experienced team of industry professionals are available to assist in our Melbourne office or the closest location to you:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5