Expert financial advice for Brisbane businesses facing liquidation.

Australian Debt Solvers are insolvency specialists with extensive experience providing liquidation services. Contact us today.

Get a Free ConsultationBrisbane Contact Details

Australian Debt Solvers continues to service a substantial amount of clients throughout Brisbane. Our Queensland headquarters is located in the heart of Brisbane, with additional office locations Australia-wide. Contact us directly via our website, call us on 1300 789 499 for a free consultation, or visit our specialist team in person at Level 14, 120 Edward St, Brisbane CBD.

- Level 14, 120 Edward St, Brisbane City QLD 4000

- Call now: 02 8324 7463

Get Your Free Consultation on Liquidation

As it can apply to solvent and insolvent companies, the liquidation process will vary depending on a number of factors. In many circumstances it is not as simple as ceasing operations, selling off any assets, and distributing accordingly.

To begin with, there may other options available to you that you may not be aware of. In addition, it is essential to understand any legal responsibilities and obligations associated with a potential liquidation. The team at Australian Debt Solvers comprises of industry professionals across all key areas including insolvency, finance, and accounting.

One of the key features of our free consultation service is flexibility. You can speak to one of our experts over the phone or arrange a face-to-face meeting at any of our office locations including Brisbane. For liquidation services and practical business solutions contact us today.

Send a Direct Message

Our Approach To Financial Success

At Australian Debt Solvers, we take nothing for granted. With a wealth of industry experience, we understand the impact that insolvency can have, and will work tirelessly to provide the help you deserve. From Brisbane to Townsville and beyond, our aim is to provide expert advice and practical solutions to those experiencing financial challenges.

Liquidation Services and Research

Whether it is voluntary or involuntary, Australian Debt Solvers has the skills and expertise to provide you with the appropriate advice. Our previous experience with businesses in Brisbane and throughout Australia has allowed us to develop a strong understanding of the financial landscape in this country. There isn't a business that we cannot help and that includes yours.

We have a dedicated team of qualified professionals that specialise in all forms of liquidation including:

- Creditors’ Voluntary Liquidation

- Members’ Voluntary Liquidation

- Provisional Liquidation

- Simplified Liquidation

A free consultation with one of our team members is the first step to a brighter financial future. With comprehensive knowledge of ASIC regulations, operational guidelines, and legal frameworks, our team will determine the most appropriate course of action. Our Liquidation Resource Centre is another useful source which provides articles written by accomplished industry personalities who provide answers to the most popular Liquidation FAQ.

The Complete Guide to Business Liquidation

One of the keys to sustained success in business is knowing what to do when things go wrong. If you have identified that your business is in a position of financial distress, it is necessary to be aware of your potential options and the impact that each may have. Our comprehensive guide to liquidation explains all of the fundamental basics including the steps involved and the role of participating parties.

Read more

What Happens to Employees When a Company Goes into Liquidation?

One of the first issues encountered by companies that go into liquidation relates to employees. As stakeholders of the business they want to know where they stand in terms of employment status and entitlements. Being transparent is useful but only possible if you are aware of the answers to critical questions such as 'Who gets paid first when a company is in liquidation?'.

Employees are entitled to unpaid wages, superannuation, annual leave, and retrenchment. If there are not enough surplus funds to pay these entitlements, employees may be able to claim through the Fair Entitlements Guarantee (FEG).

How Soon After a Wind-Up Notice Do You Have to Cease Trading?

A wind-up notice is a serious matter and is not something that can be ignored. Companies receive them as a result of failing to meet financial commitments such as tax obligations or other debts. A failure to act on such a notice could see a business wound up by the court in a matter of weeks. This emphasises the importance of acting quickly and obtaining expert advice where necessary.

Contrary to the belief of many, a wind-up notice does not mean that you must stop trading immediately. Where possible, you have the opportunity to pay the debt in full, agree on a payment plan, or enter voluntary administration. For a professional assessment and the most suitable course of action, contact us today.

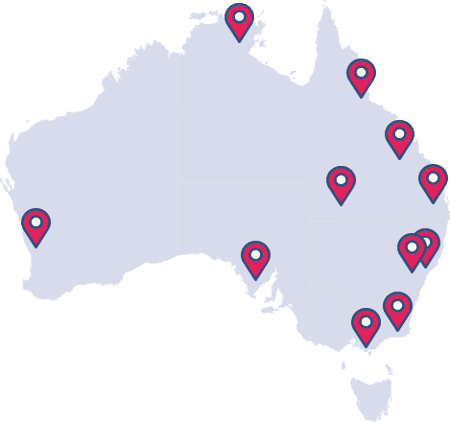

Find an Office

With office locations throughout Australia, personal service and professional insolvency advice is at your doorstep. Find your closest Australian Debt Solvers office:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5