Liquidators Registered by ASIC

Liquidation Experts

CPA and CA

Qualified Accountants

ARITA members

Restructuring & Turnaround Association

Dedicated Team

Enquiry service 24/7

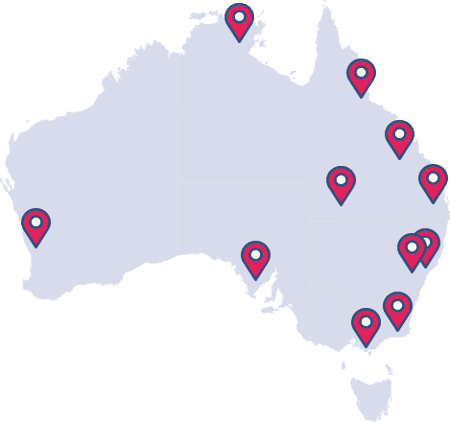

National Network

Offices across Australia

Why Trust Our Liquidation Services?

The word liquidation can strike fear into most people and many are completely unaware of both their options and obligations. That is why it is essential to seek professional advice from a registered liquidator, at Australian Debt Solvers we have in-house liquidators registered by ASIC.

Unlike many other liquidation companies, we will guide you through the entire process. Finding out if you need to liquidate is as simple as having one of our free consultations. We will assess your options, and if required, appoint one of our in-house liquidators who are registered by ASIC to take care of the rest.

Rated 5 Out of 5

What is a Company Liquidation?

Liquidation is the process of winding up a company that has been trading insolvent. Insolvent trading means a company is unable to meet its financial commitments or pay its debts. A company’s assets are subsequently liquidated (or sold) to pay debts, and the company is deregistered (or closed).

It may come as a surprise, but many directors are unaware that it is against the law to knowingly trade an entity when it is insolvent. Continuing along that path can be dangerous with directors potentially at risk of personal liability.

At Australian Debt Solvers, our aim is to take the pain out of business liquidation and minimise the stress it may cause.

Our Liquidation Services

Overwhelmed by debt, looking to dissolve a company or simply need expert assistance to resolve an issue? We have expert liquidators Australia wide that are on hand to help you understand the liquidation process.

Our experts will assess your situation, and where required, assist with a Creditors Voluntary Liquidation (CVL), Members Voluntary Liquidation (MVL) or Provisional Liquidation. We can guide you down the path of company liquidation at an affordable cost while ensuring that you carry out all of your legal obligations.

Why Australian Debt Solvers?

As indicated by our name, at Australian Debt Solvers we are all about finding solutions for our clients. Experience, expertise and personalised service are core values of our business and have allowed us to help people facing financial difficulties.

Whether you are a Director of a multi-million dollar company, an individual struggling to makes ends meet, or an accountant alarmed about a client's financial position, we can help implement a strategy that will take the pressure off.

Meet Our Liquidators

With offices in every state, people who are in financial distress can contact our expert liquidators Australia wide. As a result, our dedicated team are easily accessible and able to provide a personal service.

Having in-house liquidators that are registered by ASIC limits any potential obstacles and streamlines the company liquidation process. Our professional insolvency practitioners are on hand for free expert advice with no obligation.

Find Your Local Expert Liquidator

Australian Debt Solvers is a team of qualified professionals who specialise in providing strategic solutions for people and companies facing financial difficulties. With financial experts located across all major Australian cities, we are a national firm that provides local support. You can speak to one of our specialists 24/7 or meet with one of our experts face to face, anywhere in Australia. Contact your local Australian Debt Solvers today for a free consultation.

Company Liquidation Resource Centre

Want to learn more about Company Liquidation? Check out the Australian Debt Solvers Resource Centre which features in-depth articles written by industry professionals.

Company Liquidation Latest News

Stay up to date with the latest news from some of the foremost expert liquidators Australia has to offer. From case studies to changes in legislation you will find it all in Liquidation Latest News.

Company Liquidation FAQs

Read about our most common Company Liquidation questions and answers.

Each case is different, depending on the total debt of the company, and if the company has any assets of value.

We can get your company into liquidation within 24 hours. We will need to get some company information from you, and then the process starts.

We will email you with some basic company information required, and then we provide appointment document that the director signs.

Yes, your credit file is flagged. You can still obtain finance however, but it is of course dependent on your financial position

In most cases, NO, you are not liable for unsecured debt with creditors including the ATO – the debt goes with the business. There are some expectations such as Super and potentially PAYG with the ATO, depending on you history of lodging BAS’s. You of course also need to be aware of any Bank debt you have that may be secured or guaranteed by you personally, and leases and/or personal guarantees for other debt such as a vehicle.

We care about our customers

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible.

Rated 5 out of 5