Expert financial services in Sydney to assist with challenges of liquidation.

Australian Debt Solvers offers professional advice and comprehensive financial services delivered with expertise. Get in touch today.

Get a Free ConsultationSydney Contact Details

Australian Debt Solvers works with clients across Sydney. Our head office is located in the Sydney CBD, with other offices located throughout Australia. You can contact us directly via our website, call us on 1300 789 499 for a free consultation, or visit us in person at Level 2, 10 Bridge Street, Sydney NSW 2000

- Suite 12.02 Level 12, 20 Bridge Street, Sydney NSW 2000

- Call now: 02 8324 7463

Get Your Free Consultation on Liquidation

Liquidation is a challenging process by which the affairs of a company are brought to an end. Also known as winding-up or dissolution, liquidation typically involves insolvency and can be either involuntary or voluntary in nature. During this process, the assets and property of the company are redistributed between invested parties, with this sensitive process often causing a range of financial and legal problems.

Expert consultation is the key to every successful liquidation. With access to professional knowledge and advice, you can make the right decisions and put your best foot forward. If you're thinking about liquidating your business in Australia, we offer a free consultation service to help you define the best course of action. We work with your team throughout the process and create effective liquidation solutions based on best practice outcomes.

Send a Direct Message

Our Approach To Financial Success

At Australian Debt Solvers, we approach each financial scenario with respect and professionalism. Each client and situation is unique, and every challenge creates an opportunity for growth. We combine expert knowledge and industry experience with professional responsibility and attention to detail.

As the leading financial advisory service in Australia, our uncompromising and professional approach is reflected in numerous success stories. We have worked with thousands of clients in Sydney and helped countless people to move forward and overcome their financial challenges. If you need inspiration and practical advice during a tough time, please watch our video to see how we can help you.

Liquidation Services and Research

Australian Debt Solvers specialises in liquidation cases across Sydney and throughout Australia. Whether you own a small family business or run a large corporation, access to professional advice and expert guidance is essential throughout the liquidation process. We can help and advise you with key components of the liquidation process including:

- sell and distribute any assets

- pay creditors and shareholders

- manage your financial responsibilities, and

- advise you with respect to your legal obligations.

We have the necessary experience to deal with all types of liquidation cases including including involuntary liquidation and voluntary liquidation. Our liquidation services include Creditors’ Voluntary Liquidation, Members’ Voluntary Liquidation, Provisional Liquidation, and Simplified Liquidation.

The Australian Debt Solvers Liquidation Resource Centre and liquidation FAQ guide provide useful information and can help answer some key questions that you may currently have.

How Soon After a Wind-Up Notice Do You Have to Cease Trading?

Companies that have trouble meeting their tax obligations, or other debts, may receive a notice to wind-up from creditors or the ATO. Business owners and company directors are often confused about the impact of receiving a wind-up notice, and uncertain about what their options may be. A wind-up notice is a serious matter, and it’s important that you act quickly, even if you need time to obtain professional advice and explore your options.

Read more

The Complete Guide to Business Liquidation

When your business is in financial trouble, there are a number of potential solutions available. The best way to explore these options is by obtaining expert advice. Our team of insolvency professionals can analyse your financial situation to identify potential alternative options prior to proceeding down the path of liquidation.

Read more

What Happens to Employees When a Company Goes into Liquidation?

When a business becomes unprofitable and is unable to service its debt, it may have to enter administration or liquidation. As the company is wound up, employees are one of the first parties to be affected. In addition to losing their job, they’ll be most concerned about getting paid for work they’ve already done. Learn more about the your legal obligations and the rights of employees during the liquidation process.

Read more

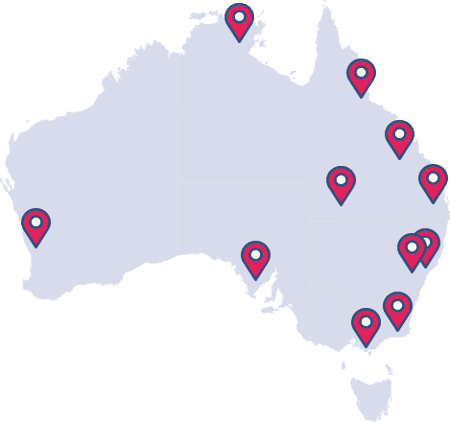

Find an Office

Australian Debt Solvers are experts in helping people through potential bankruptcy and insolvency across Australia. Find the closest office to you:

We care about our customer

At Australian Debt solvers we take feedback seriously and pride ourselves on providing the best customer services possible

Rated 5 out of 5